| Zacks Company Profile for Envista Holdings Corporation (NVST : NYSE) |

|

|

| |

| • Company Description |

| Envista Holdings Corporation manufactures and sells dental products primarily in the United States and internationally. The company's Specialty Products & Technologies segment provides dental implant systems, guided surgery systems, biomaterials, prefabricated and custom-built prosthetics and dental eye loupes to oral surgeons, prosthodontists and periodontists; Equipment & Consumables segment develops, manufactures and markets dental equipment and supplies used in dental offices, including digital imaging systems, software and other visualization/magnification systems; handpieces and associated consumables; treatment units and other dental practice equipment; endodontic systems and related consumables; restorative materials and instruments, rotary burs, impression materials, bonding agents and cements and infection prevention products. Envista Holdings Corporation is based in Brea, California.

Number of Employees: 12,000 |

|

|

| |

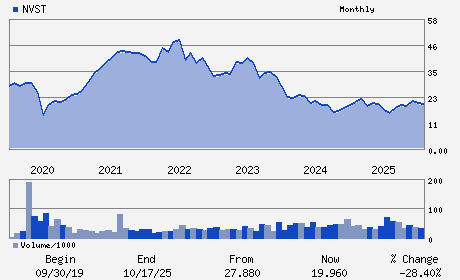

| • Price / Volume Information |

| Yesterday's Closing Price: $29.21 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,729,116 shares |

| Shares Outstanding: 163.88 (millions) |

| Market Capitalization: $4,786.80 (millions) |

| Beta: 0.95 |

| 52 Week High: $30.36 |

| 52 Week Low: $14.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

24.46% |

25.55% |

| 12 Week |

44.39% |

44.21% |

| Year To Date |

34.55% |

33.89% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

200 S. KRAEMER BLVD. BUILDING E

-

BREA,CA 92821

USA |

ph: 714-817-7000

fax: 714-817-5450 |

ir@envistaco.com |

http://www.envistaco.com |

|

|

| |

| • General Corporate Information |

Officers

Paul Keel - President; Chief Executive Officer

Scott Huennekens - Chairman of the Board

Eric Hammes - Senior Vice President and Chief Financial Officer

Faez Kaabi - Vice President

Wendy Carruthers - Director

|

|

Peer Information

Envista Holdings Corporation (BJCT)

Envista Holdings Corporation (CADMQ)

Envista Holdings Corporation (APNO)

Envista Holdings Corporation (UPDC)

Envista Holdings Corporation (IMTIQ)

Envista Holdings Corporation (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 29415F104

SIC: 3843

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 163.88

Most Recent Split Date: (:1)

Beta: 0.95

Market Capitalization: $4,786.80 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.31 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.41 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 10.41% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |