| Zacks Company Profile for Quanex Building Products Corporation (NX : NYSE) |

|

|

| |

| • Company Description |

| Quanex Building Products Corporation is an industry-leading manufacturer of components sold to Original Equipment Manufacturers in building products industry. Quanex designs and produces energy-efficient fenestration products in addition to kitchen and bath cabinet components. These components can be categorized as window and door (fenestration) components and kitchen and bath cabinet components. Examples of fenestration components include (1) energy-efficient flexible insulating glass spacers, (2) extruded vinyl profiles, (3) window and door screens, and (4) precision-formed metal and wood products. In addition, Quanex provide certain other non-fenestration components and products, which include solar panel sealants, wood flooring, trim moldings, vinyl decking, fencing, water retention barriers, and conservatory roof components. Quanex use low-cost production processes and engineering expertise to provide customers with specialized products for their specific window, door, and cabinet applications.

Number of Employees: 7,071 |

|

|

| |

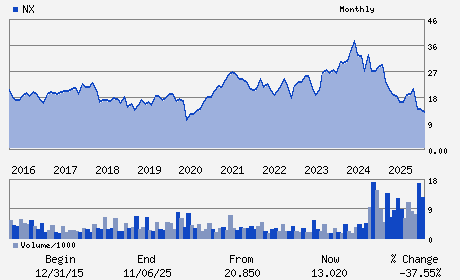

| • Price / Volume Information |

| Yesterday's Closing Price: $20.33 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 517,077 shares |

| Shares Outstanding: 45.94 (millions) |

| Market Capitalization: $933.93 (millions) |

| Beta: 0.91 |

| 52 Week High: $22.98 |

| 52 Week Low: $11.04 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.94% |

8.42% |

| 12 Week |

49.82% |

49.05% |

| Year To Date |

32.19% |

31.49% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

George L. Wilson - Chairman; President and Chief Executive Officer

Scott M. Zuehlke - Senior Vice President; Chief Financial Officer and

Gabriela Garcia - Vice President

Susan F. Davis - Director

Donald R. Maier - Director

|

|

Peer Information

Quanex Building Products Corporation (CSRLY)

Quanex Building Products Corporation (ARRD)

Quanex Building Products Corporation (CGMCQ)

Quanex Building Products Corporation (CMCJY)

Quanex Building Products Corporation (OMRP)

Quanex Building Products Corporation (ABLT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG&CONST-MISC

Sector: Construction

CUSIP: 747619104

SIC: 3350

|

|

Fiscal Year

Fiscal Year End: October

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 45.94

Most Recent Split Date: 4.00 (1.50:1)

Beta: 0.91

Market Capitalization: $933.93 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.57% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.38 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $2.10 |

Payout Ratio: 0.14 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.01 |

| Estmated Long-Term EPS Growth Rate: 14.00% |

Last Dividend Paid: 12/15/2025 - $0.08 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |