| Zacks Company Profile for Olin Corporation (OLN : NYSE) |

|

|

| |

| • Company Description |

| Olin Corporation is a vertically-integrated global producer and distributor of chemical products and U.S. maker of ammunition. Internationally, the company operates in regions including Latin America, Asia Pacific and Europe. Olin's operations are focused in three business segments: Chlor Alkali Products and Vinyls, Epoxy and Winchester. Chlor Alkali Products and Vinyls segment produces and sells chlorine and caustic soda, vinyl chloride monomer and ethylene dichloride, methylene chloride, methyl chloride, carbon tetrachloride, chloroform, trichloroethylene, perchloroethylene, hydrochloric acid, vinylidene chloride, hydrogen, potassium hydroxide and bleach products. The division is one of the largest marketers of caustic soda in Brazil. The company's diversified caustic soda sourcing enables it to supply global customers cost effectively.

Number of Employees: 7,849 |

|

|

| |

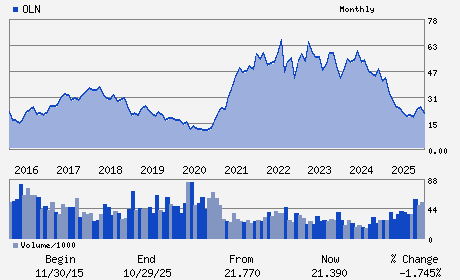

| • Price / Volume Information |

| Yesterday's Closing Price: $24.47 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,859,634 shares |

| Shares Outstanding: 113.64 (millions) |

| Market Capitalization: $2,780.69 (millions) |

| Beta: 1.56 |

| 52 Week High: $27.35 |

| 52 Week Low: $17.66 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.81% |

-3.63% |

| 12 Week |

13.44% |

13.73% |

| Year To Date |

17.48% |

17.06% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kenneth Lane - President and Chief Executive Officer and Director

William H. Weideman - Chairman and Director

Todd A. Slater - Senior Vice President and Chief Financial Officer

Randee N. Sumner - Vice President and Controller

Beverley A. Babcock - Director

|

|

Peer Information

Olin Corporation (ENFY)

Olin Corporation (EMLIF)

Olin Corporation (GPLB)

Olin Corporation (BCPUQ)

Olin Corporation (CYT.)

Olin Corporation (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 680665205

SIC: 2800

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 113.64

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.56

Market Capitalization: $2,780.69 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.27% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.71 |

Indicated Annual Dividend: $0.80 |

| Current Fiscal Year EPS Consensus Estimate: $-0.93 |

Payout Ratio: 1.38 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.93 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |