| Zacks Company Profile for Olaplex Holdings, Inc. (OLPX : NSDQ) |

|

|

| |

| • Company Description |

| Olaplex Holdings Inc. is a technology-driven beauty company. The brand's products have an active, patent-protected ingredient which works on a molecular level to protect and repair hair from damage. The company's products are sold through omni-channel platform serving the professional, specialty retail and direct-to-consumer channels. Olaplex Holdings Inc. is based in SANTA BARBARA, Calif.

Number of Employees: 231 |

|

|

| |

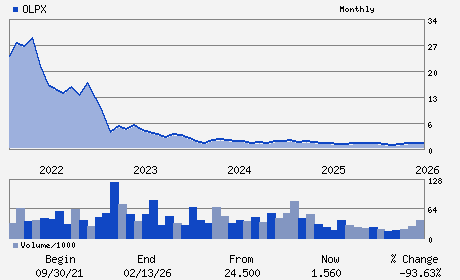

| • Price / Volume Information |

| Yesterday's Closing Price: $1.61 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 837,596 shares |

| Shares Outstanding: 667.51 (millions) |

| Market Capitalization: $1,074.69 (millions) |

| Beta: 2.24 |

| 52 Week High: $1.84 |

| 52 Week Low: $0.99 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.90% |

2.79% |

| 12 Week |

28.80% |

28.64% |

| Year To Date |

20.15% |

19.57% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Amanda Baldwin - Chief Executive Officer

John P. Bilbrey - Chairman

Catherine Dunleavy - Chief Operating Officer and Chief Financial Office

Kenneth F. Egan - Chief Accounting Officer

Tricia Glynn - Director

|

|

Peer Information

Olaplex Holdings, Inc. (LENXQ)

Olaplex Holdings, Inc. (BFXXQ)

Olaplex Holdings, Inc. (CENT)

Olaplex Holdings, Inc. (FTDL)

Olaplex Holdings, Inc. (BTH)

Olaplex Holdings, Inc. (JAH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONSM PD-MISC DIS

Sector: Consumer Discretionary

CUSIP: 679369108

SIC: 2844

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 667.51

Most Recent Split Date: (:1)

Beta: 2.24

Market Capitalization: $1,074.69 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.02 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.08 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |