| Zacks Company Profile for Omnicom Group Inc. (OMC : NYSE) |

|

|

| |

| • Company Description |

| Omnicom is one of the largest advertising, marketing and corporate communications companies in the world. The company's agencies operate in all the major markets across the globe and provide an extensive range of services. Areas of operation include North America, Latin America, Europe, the Middle East, Australia, China, India, Japan, Korea, Africa, New Zealand, Singapore, and other Asian countries. The company operates in a fiercely competitive industry and competes with global, national and regional advertising and marketing services companies. It also competes with technology, social media and professional services companies.

Number of Employees: 120,000 |

|

|

| |

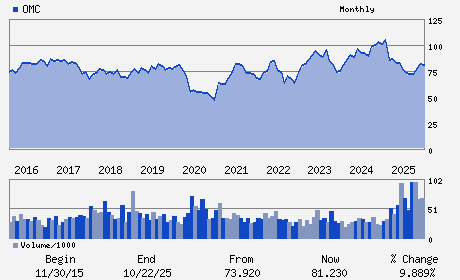

| • Price / Volume Information |

| Yesterday's Closing Price: $85.29 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,269,021 shares |

| Shares Outstanding: 310.34 (millions) |

| Market Capitalization: $26,468.59 (millions) |

| Beta: 0.71 |

| 52 Week High: $89.27 |

| 52 Week Low: $66.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.71% |

11.68% |

| 12 Week |

16.14% |

15.99% |

| Year To Date |

5.62% |

5.11% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John D. Wren - Chief Executive Officer; Chairman and Director

Philippe Krakowsky - Co-President; Co-Chief Operating Officer and Direc

Philip J. Angelastro - Executive Vice President and Chief Financial Offic

Andrew L. Castellaneta - Senior Vice President; Chief Accounting Officer

Mary C. Choksi - Director

|

|

Peer Information

Omnicom Group Inc. (IBDI)

Omnicom Group Inc. (VAPR)

Omnicom Group Inc. (SWWI)

Omnicom Group Inc. (GREY)

Omnicom Group Inc. (JCDXF)

Omnicom Group Inc. (GMIG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ADVERTISING/MKTG SVCS

Sector: Business Services

CUSIP: 681919106

SIC: 7311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/21/26

|

|

Share - Related Items

Shares Outstanding: 310.34

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.71

Market Capitalization: $26,468.59 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.75% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.90 |

Indicated Annual Dividend: $3.20 |

| Current Fiscal Year EPS Consensus Estimate: $9.89 |

Payout Ratio: 0.37 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 6.79% |

Last Dividend Paid: 12/19/2025 - $0.80 |

| Next EPS Report Date: 04/21/26 |

|

|

|

| |