| Zacks Company Profile for Onto Innovation Inc. (ONTO : NYSE) |

|

|

| |

| • Company Description |

| Onto Innovation operates as the leading global manufacturer of avant-garde process control tools that perform macro defect inspections and metrology, and lithography systems. Its products are used in a number of high technology industries like silicon wafer substrates, power device and data storage. It plays a significant role in the design, manufacture and marketing of process control systems for 2D/ 3D macro inspection, optical critical dimension metrology and wafer inspection. It boasts a broad portfolio of leading-edge technologies: metal interconnect composition, factory analytics and lithography for advanced semiconductor packaging, as well as develops innovative analytical software for certain industrial applications. By its management efficiency, customers get a first-hand access of premium products at premium prices. It provides best-in-class direct sales & application support through its offices located in the U.S., Japan, Taiwan, South Korea, China, Singapore and Europe. It has 1 business segment.

Number of Employees: 1,615 |

|

|

| |

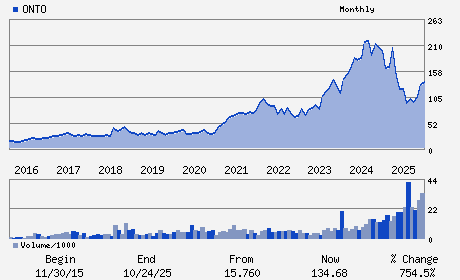

| • Price / Volume Information |

| Yesterday's Closing Price: $215.89 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,057,212 shares |

| Shares Outstanding: 49.70 (millions) |

| Market Capitalization: $10,730.24 (millions) |

| Beta: 1.47 |

| 52 Week High: $232.49 |

| 52 Week Low: $85.88 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.85% |

7.78% |

| 12 Week |

37.16% |

36.99% |

| Year To Date |

36.76% |

36.10% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael P. Plisinski - Chief Executive Officer

Brian K. Roberts - Chief Financial Officer

Stephen D. Kelley - Director

Susan D. Lynch - Director

David B. Miller - Director

|

|

Peer Information

Onto Innovation Inc. (ONTO)

Onto Innovation Inc. (NMGX)

Onto Innovation Inc. (XDSL)

Onto Innovation Inc. (MHTX)

Onto Innovation Inc. (CBNT)

Onto Innovation Inc. (BTZI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Nanotechnology

Sector: Computer and Technology

CUSIP: 683344105

SIC: 3829

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 49.70

Most Recent Split Date: (:1)

Beta: 1.47

Market Capitalization: $10,730.24 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.32 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $6.37 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 30.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |