| Zacks Company Profile for Ostin Technology Group Co., Ltd. (OST : NSDQ) |

|

|

| |

| • Company Description |

| Ostin Technology Group Co., Ltd. is a supplier of display modules and polarizers principally in China. The Company designs, develops and manufactures TFT-LCD display modules in a wide range of sizes and customized sizes which are mainly used in consumer electronics, outdoor LCD displays and automotive displays. It also manufactures polarizers used in the TFT-LCD display modules. Ostin Technology Group Co., Ltd., formerly known as OSTEN TECH GRP, is based in Nanjing, China.

Number of Employees: 352 |

|

|

| |

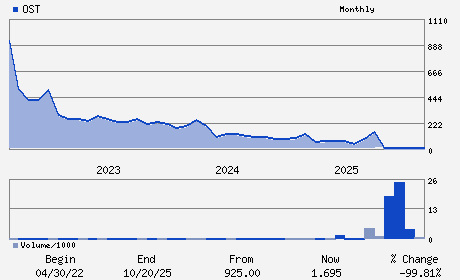

| • Price / Volume Information |

| Yesterday's Closing Price: $1.70 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 0 shares |

| Shares Outstanding: 5.99 (millions) |

| Market Capitalization: $10.16 (millions) |

| Beta: 0.65 |

| 52 Week High: $235.00 |

| 52 Week Low: $1.35 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.00% |

0.87% |

| 12 Week |

0.00% |

-0.12% |

| Year To Date |

0.00% |

-0.49% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Building 2 101 1 Kechuang Road Qixia District

-

Nanjing,F4 210046

CHN |

ph: 86-25-5859-5234

fax: 86-577-8659-8888 |

ir@austinelec.com |

http://ostin-technology.com |

|

|

| |

| • General Corporate Information |

Officers

Tao Ling - Chief Executive Officer and Chairman of the Board

Qiaoyun Xie - Chief Financial Officer

Xiaodong Zhai - Chief Technology Officer

Xiaohong Yin - Secretary and Director

Rongguo Cui - Director

|

|

Peer Information

Ostin Technology Group Co., Ltd. (SMTI.)

Ostin Technology Group Co., Ltd. (DDICQ)

Ostin Technology Group Co., Ltd. (CGGIQ)

Ostin Technology Group Co., Ltd. (CRDN)

Ostin Technology Group Co., Ltd. (CDTS)

Ostin Technology Group Co., Ltd. (AURAQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC-MISC COMPONENTS

Sector: Computer and Technology

CUSIP: G67927122

SIC: 3679

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: -

Next Expected EPS Date: 04/27/26

|

|

Share - Related Items

Shares Outstanding: 5.99

Most Recent Split Date: 8.00 (0.04:1)

Beta: 0.65

Market Capitalization: $10.16 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/27/26 |

|

|

|

| |