| Zacks Company Profile for OraSure Technologies, Inc. (OSUR : NSDQ) |

|

|

| |

| • Company Description |

| OraSure Technologies, Inc. develops, manufactures and markets oral fluid specimen collection devices using proprietary oral fluid technologies, diagnostic products including immunoassays and other in vitro diagnostic tests, and other medical devices. These products are sold in the United States as well as internationally to various clinical laboratories, hospitals, clinics, community-based organizations and other public health organizations, distributors, government agencies, physicians' offices, and commercial and industrial entities. OraSure Technologies is the leading supplier of oral-fluid collection devices and in vitro diagnostic assays to the employment, criminal justice, drug treatment, life insurance and public health markets for the detection of abused drugs and the antibodies to HIV. Based in Bethlehem, Pennsylvania, the Company develops, manufactures and markets oral specimen collection devices, in vitro diagnostic tests, and other medical devices.

Number of Employees: 501 |

|

|

| |

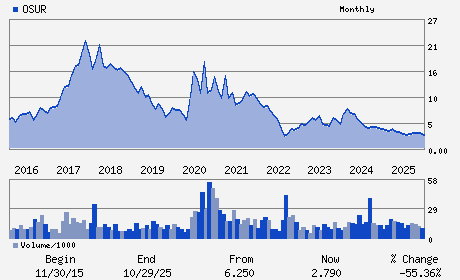

| • Price / Volume Information |

| Yesterday's Closing Price: $3.15 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 457,662 shares |

| Shares Outstanding: 71.73 (millions) |

| Market Capitalization: $225.96 (millions) |

| Beta: 0.88 |

| 52 Week High: $4.22 |

| 52 Week Low: $2.08 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.90% |

13.89% |

| 12 Week |

26.51% |

26.35% |

| Year To Date |

30.17% |

29.53% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Carrie Eglinton Manner - Chief Executive Officer and President

Kenneth J. McGrath - Chief Financial Officer

Michele Anthony - Senior Vice President; Controller & Chief Accounti

Mara G. Aspinall - Director

Nancy J. Gagliano - Director

|

|

Peer Information

OraSure Technologies, Inc. (BJCT)

OraSure Technologies, Inc. (CADMQ)

OraSure Technologies, Inc. (APNO)

OraSure Technologies, Inc. (UPDC)

OraSure Technologies, Inc. (IMTIQ)

OraSure Technologies, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 68554V108

SIC: 3841

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 71.73

Most Recent Split Date: 4.00 (3.00:1)

Beta: 0.88

Market Capitalization: $225.96 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.20 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.84 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |