| Zacks Company Profile for Otis Worldwide Corporation (OTIS : NYSE) |

|

|

| |

| • Company Description |

| Otis Worldwide Corp. is one of the leading elevator and escalator manufacturing, installation and service provider to commercial, housing associations, government associations, etc. Otis has expanded business in multiple countries across the world in more than 1,400 branches and offices. Raytheon Technologies Corp. completed the tax-free spin-off of Otis Worldwide Corp and Carrier Global Corp. It has 2 reporting segments: New Equipment & Service. The New Equipment segment manufactures, sells and installs a wide range of passenger and freight elevators, escalators and moving walkways for residential, commercial and infrastructure projects. It has developed a range of elevator and escalator solutions, including Gen360 elevator & Gen2 system. The Service segment performs maintenance & repair and modernization services to upgrade elevators, and escalators. It has a maintenance portfolio of more than 2 million units throughout the globe. Otis provides maintenance services to other manufacturers.

Number of Employees: 72,000 |

|

|

| |

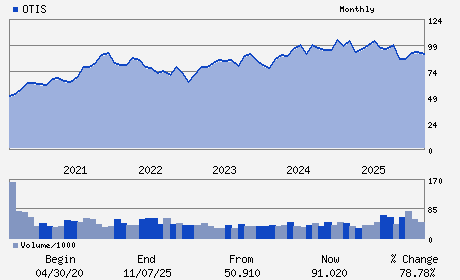

| • Price / Volume Information |

| Yesterday's Closing Price: $92.56 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,060,781 shares |

| Shares Outstanding: 388.72 (millions) |

| Market Capitalization: $35,979.99 (millions) |

| Beta: 1.00 |

| 52 Week High: $106.83 |

| 52 Week Low: $84.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.36% |

9.31% |

| 12 Week |

7.07% |

6.94% |

| Year To Date |

5.96% |

5.45% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Judith F. Marks - Chairman President and Chief Executive Officer

Joseph Armas - President

Enrique Minarro Viseras - Chief Operating Officer

Cristina Mendez - Executive Vice President and Chief Financial Offic

Neil Green - Executive Vice President

|

|

Peer Information

Otis Worldwide Corporation (B.)

Otis Worldwide Corporation (DXPE)

Otis Worldwide Corporation (AIT)

Otis Worldwide Corporation (GDI.)

Otis Worldwide Corporation (CTITQ)

Otis Worldwide Corporation (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 68902V107

SIC: 3600

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 388.72

Most Recent Split Date: (:1)

Beta: 1.00

Market Capitalization: $35,979.99 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.82% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.96 |

Indicated Annual Dividend: $1.68 |

| Current Fiscal Year EPS Consensus Estimate: $4.32 |

Payout Ratio: 0.41 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: 7.68% |

Last Dividend Paid: 02/13/2026 - $0.42 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |