| Zacks Company Profile for Plains All American Pipeline, L.P. (PAA : NSDQ) |

|

|

| |

| • Company Description |

| Plains All American Pipeline, L.P., a master limited partnership, is involved in the transportation, storage, terminalling and marketing of crude oil, natural gas, natural gas liquids and refined products. The partnership has operations in the Permian Basin, South Texas/Eagle Ford area, Rocky Mountain and Gulf Coast in the U.S., and Manito, South Saskatchewan, Rainbow in Canada. The firm reorganized the historical operating segments' namely Transportation, Facilities and Supply and Logistics' into two operating segments: Crude Oil and Natural gas liquids (NGL). Crude Oil segment assets include pipelines, storage, terminalling and trucks. This segment generates revenues from long-term minimum volume commitments, acreage dedications, leased capacity & spot utilization. The Crude Oil segment will be driven by an increase in production volumes and rise in volume throughput. NGL segment asset include fractionation, straddle, pipelines, storage,terminalling & rail capacity.

Number of Employees: 4,200 |

|

|

| |

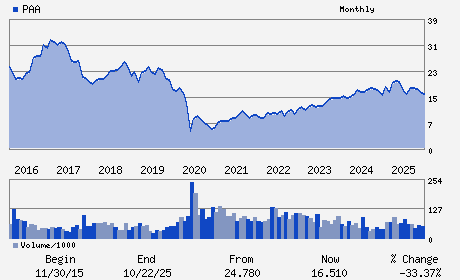

| • Price / Volume Information |

| Yesterday's Closing Price: $20.91 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,091,670 shares |

| Shares Outstanding: 705.50 (millions) |

| Market Capitalization: $14,751.96 (millions) |

| Beta: 0.58 |

| 52 Week High: $21.43 |

| 52 Week Low: $15.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.68% |

9.63% |

| 12 Week |

17.94% |

17.79% |

| Year To Date |

16.42% |

15.86% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

333 CLAY STREET SUITE 1600

-

HOUSTON,TX 77002

USA |

ph: 713-646-4100

fax: 713-646-4680 |

plainsir@plains.com |

http://www.plains.com |

|

|

| |

| • General Corporate Information |

Officers

Willie Chiang - Chief Executive Officer; Chairman and Director

Harry N. Pefanis - President

Chris R. Chandler - Executive Vice President and Chief Operating Offic

Al Swanson - Executive Vice President and Chief Financial Offic

Greg L. Armstrong - Director

|

|

Peer Information

Plains All American Pipeline, L.P. (KMP)

Plains All American Pipeline, L.P. (OMP)

Plains All American Pipeline, L.P. (WMZ)

Plains All American Pipeline, L.P. (BPL)

Plains All American Pipeline, L.P. (PAA)

Plains All American Pipeline, L.P. (EEP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Oil/Gas Prod Pipeline MLP

Sector: Oils/Energy

CUSIP: 726503105

SIC: 4610

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/08/26

|

|

Share - Related Items

Shares Outstanding: 705.50

Most Recent Split Date: 10.00 (2.00:1)

Beta: 0.58

Market Capitalization: $14,751.96 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 7.99% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.43 |

Indicated Annual Dividend: $1.67 |

| Current Fiscal Year EPS Consensus Estimate: $1.62 |

Payout Ratio: 0.99 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.18 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/30/2026 - $0.42 |

| Next EPS Report Date: 05/08/26 |

|

|

|

| |