| Zacks Company Profile for Grupo Aeroportuario Del Pacifico, S.A. de C.V. (PAC : NYSE) |

|

|

| |

| • Company Description |

| Grupo Aeroportuario del Pacifico was constituted as part of the process of opening to the private investment the Mexican airport system. Currently the aeronautic infrastructure has become the base of every service of air transportation; constituting this a pole of development around which a series of activities of great economic importance is articulated: business, aeronautic services, commerce, business, etc. It administers, operates, maintains and develops twelve airports in the regions of the Pacific and Center of Mexico, in the cities of Guadalajara, Hermosillo, Puerto Vallarta, Aguascalientes, La Paz, Tijuana, Leon, among other.

Number of Employees: 3,275 |

|

|

| |

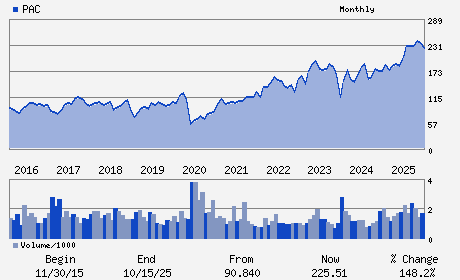

| • Price / Volume Information |

| Yesterday's Closing Price: $260.76 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 111,759 shares |

| Shares Outstanding: (millions) |

| Market Capitalization: $ (millions) |

| Beta: 1.01 |

| 52 Week High: $300.41 |

| 52 Week Low: $168.62 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.15% |

-4.32% |

| 12 Week |

14.78% |

14.64% |

| Year To Date |

-1.09% |

-1.57% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Raul Revuelta Musalem - Chief Executive Officer

Laura Diez-Barroso Azcarraga - Chairwoman and Director

Saul Villarreal Garcia - Chief Financial Officer

Emilio Rotondo Inclan - Director

Juan Gallardo Thurlow - Director

|

|

Peer Information

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (HKAEY)

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (UHAL)

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (LYNG)

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (MATX)

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (GLC)

Grupo Aeroportuario Del Pacifico, S.A. de C.V. (FAVS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SERVICES

Sector: Transportation

CUSIP: 400506101

SIC: 4581

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding:

Most Recent Split Date: (:1)

Beta: 1.01

Market Capitalization: $ (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.03% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.54 |

Indicated Annual Dividend: $7.90 |

| Current Fiscal Year EPS Consensus Estimate: $13.59 |

Payout Ratio: 0.77 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: 0.26 |

| Estmated Long-Term EPS Growth Rate: 12.66% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |