| Zacks Company Profile for Phibro Animal Health Corporation (PAHC : NSDQ) |

|

|

| |

| • Company Description |

| Phibro Animal Health Corporation is a leading global diversified animal health and mineral nutrition company. The company provides a broad range of products for food animals including poultry, swine, beef and dairy cattle and aquaculture. In addition to animal health and mineral nutrition products, Phibro manufactures and markets specific ingredients for use in the personal care, automotive, industrial chemical and chemical catalyst industries. Currently, Phibro focuses on regions where the majority of livestock production is consolidated in large commercial farms such as the U.S., Brazil, China, Russia, Mexico, Australia, Turkey, Israel, Canada and Europe.

Number of Employees: 2,475 |

|

|

| |

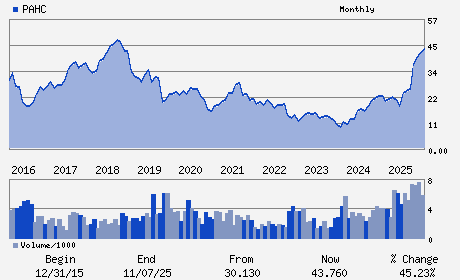

| • Price / Volume Information |

| Yesterday's Closing Price: $54.54 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 318,975 shares |

| Shares Outstanding: 40.53 (millions) |

| Market Capitalization: $2,210.76 (millions) |

| Beta: 0.74 |

| 52 Week High: $56.30 |

| 52 Week Low: $16.16 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

30.14% |

31.93% |

| 12 Week |

36.08% |

35.38% |

| Year To Date |

45.99% |

45.22% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

GLENPOINTE CENTRE EAST 3RD FLOOR 300 FRANK W. BURR BLVD. SUITE 21

-

TEANECK,NJ 07666

USA |

ph: 201-329-7300

fax: 201-329-7399 |

investor.relations@pahc.com |

http://www.pahc.com |

|

|

| |

| • General Corporate Information |

Officers

Jack C. Bendheim - Chairman; President and Chief Executive Officer

Glenn C. David - Chief Financial Officer

Daniel M. Bendheim - Executive Vice President;Director and Corporate St

Alejandro Bernal - Director

E. Thomas Corcoran - Director

|

|

Peer Information

Phibro Animal Health Corporation (BJCT)

Phibro Animal Health Corporation (CADMQ)

Phibro Animal Health Corporation (APNO)

Phibro Animal Health Corporation (UPDC)

Phibro Animal Health Corporation (IMTIQ)

Phibro Animal Health Corporation (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 71742Q106

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 40.53

Most Recent Split Date: (:1)

Beta: 0.74

Market Capitalization: $2,210.76 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.88% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.72 |

Indicated Annual Dividend: $0.48 |

| Current Fiscal Year EPS Consensus Estimate: $3.02 |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.18 |

| Estmated Long-Term EPS Growth Rate: 21.51% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |