| Zacks Company Profile for Pangaea Logistics Solutions Ltd. (PANL : NSDQ) |

|

|

| |

| • Company Description |

| Pangaea Logistics Solutions Ltd. operates as a global logistics company. It provides seaborne drybulk transportation services. The Company provides logistics services to a broad base of industrial customers who require the transportation of a wide variety of dry bulk cargoes, including grains, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone. It provides dry bulk cargo transportation services for steel, aluminum, energy, agricultural, and other sectors. Pangaea Logistics Solutions Ltd. is headquartered in Newport, Rhode Island.

Number of Employees: 170 |

|

|

| |

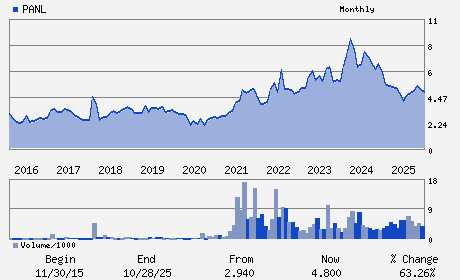

| • Price / Volume Information |

| Yesterday's Closing Price: $9.32 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 598,068 shares |

| Shares Outstanding: 64.97 (millions) |

| Market Capitalization: $605.55 (millions) |

| Beta: 0.77 |

| 52 Week High: $9.39 |

| 52 Week Low: $3.93 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.91% |

7.37% |

| 12 Week |

29.44% |

28.78% |

| Year To Date |

35.47% |

34.75% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mark L. Filanowski - Chief Executive Officer

Richard T. du Moulin - Chairman

Gianni DelSignore - Chief Financial Officer; Principal Financial and A

Carl Claus Boggild - Director

Anthony Laura - Director

|

|

Peer Information

Pangaea Logistics Solutions Ltd. (BHODQ)

Pangaea Logistics Solutions Ltd. (GNK.2)

Pangaea Logistics Solutions Ltd. (NPTOY)

Pangaea Logistics Solutions Ltd. (SCRB)

Pangaea Logistics Solutions Ltd. (SHWK)

Pangaea Logistics Solutions Ltd. (ACLNF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-SHIP

Sector: Transportation

CUSIP: G6891L105

SIC: 4412

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 64.97

Most Recent Split Date: (:1)

Beta: 0.77

Market Capitalization: $605.55 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.15% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.20 |

| Current Fiscal Year EPS Consensus Estimate: $0.39 |

Payout Ratio: 0.71 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.34 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/27/2026 - $0.10 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |