| Zacks Company Profile for UiPath, Inc. (PATH : NYSE) |

|

|

| |

| • Company Description |

| UiPath Inc. offers an end-to-end platform for automation, combining Robotic Process Automation solution for digital business operations. UiPath Inc. is based in New York, United States.

Number of Employees: 3,868 |

|

|

| |

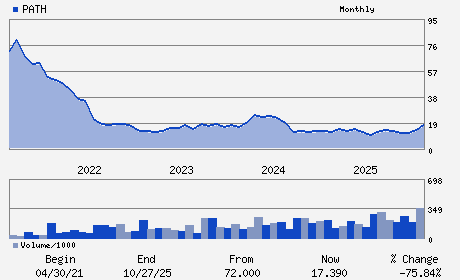

| • Price / Volume Information |

| Yesterday's Closing Price: $10.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 32,053,616 shares |

| Shares Outstanding: 534.75 (millions) |

| Market Capitalization: $5,737.87 (millions) |

| Beta: 1.07 |

| 52 Week High: $19.84 |

| 52 Week Low: $9.38 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-19.02% |

-17.96% |

| 12 Week |

-41.94% |

-42.12% |

| Year To Date |

-34.53% |

-35.26% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Daniel Dines - Chief Executive Officer and Chairman

Ashim Gupta - Chief Financial Officer and Chief Operating Office

Hitesh Ramani - Chief Accounting Officer and Deputy Chief Financia

Philippe Botteri - Director

Michael Gordon - Director

|

|

Peer Information

UiPath, Inc. (ADP)

UiPath, Inc. (CWLD)

UiPath, Inc. (CYBA.)

UiPath, Inc. (ZVLO)

UiPath, Inc. (AZPN)

UiPath, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 90364P105

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/11/26

|

|

Share - Related Items

Shares Outstanding: 534.75

Most Recent Split Date: (:1)

Beta: 1.07

Market Capitalization: $5,737.87 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.03 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.30 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 24.13% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/11/26 |

|

|

|

| |