| Zacks Company Profile for Paychex, Inc. (PAYX : NSDQ) |

|

|

| |

| • Company Description |

| Paychex, Inc. is a recognized leader in the payroll, human resource, and benefits outsourcing industry, with a steadfast commitment to success and a record of achievement that continues a tradition of delivering excellence. The company offers an ever-growing variety of payroll and human resource products and services that help clients do what they do best - run their business. With a wide range of services - including payroll processing, retirement services, insurance, and a fully outsourced human resource solution - Paychex customizes its offering to the client's business, whether it is small or large, simple or complex.

Number of Employees: 19,000 |

|

|

| |

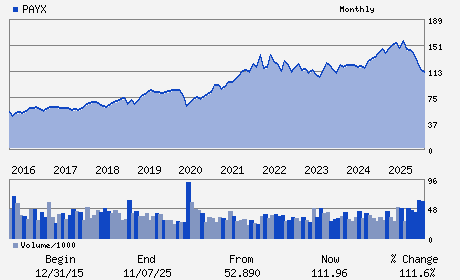

| • Price / Volume Information |

| Yesterday's Closing Price: $95.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,117,596 shares |

| Shares Outstanding: 358.97 (millions) |

| Market Capitalization: $34,385.49 (millions) |

| Beta: 0.91 |

| 52 Week High: $161.24 |

| 52 Week Low: $86.89 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.73% |

-2.54% |

| 12 Week |

-15.14% |

-14.93% |

| Year To Date |

-14.61% |

-14.91% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John B. Gibson - Chief Executive Officer; President and Director

Robert L. Schrader - Senior Vice President and Chief Financial Officer

Christopher Simmons - Vice President; Controller and Treasurer

Martin Mucci - Director

Thomas F. Bonadio - Director

|

|

Peer Information

Paychex, Inc. (ADP)

Paychex, Inc. (CWLD)

Paychex, Inc. (CYBA.)

Paychex, Inc. (ZVLO)

Paychex, Inc. (AZPN)

Paychex, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 704326107

SIC: 8700

|

|

Fiscal Year

Fiscal Year End: May

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 03/25/26

|

|

Share - Related Items

Shares Outstanding: 358.97

Most Recent Split Date: 5.00 (1.50:1)

Beta: 0.91

Market Capitalization: $34,385.49 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.51% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.34 |

Indicated Annual Dividend: $4.32 |

| Current Fiscal Year EPS Consensus Estimate: $5.44 |

Payout Ratio: 0.84 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/28/2026 - $1.08 |

| Next EPS Report Date: 03/25/26 |

|

|

|

| |