| Zacks Company Profile for Pembina Pipeline Corp. (PBA : NYSE) |

|

|

| |

| • Company Description |

| Pembina Pipeline Corporation is a Canada-based vertically integrated operator of energy infrastructure assets. The company is active throughout the hydrocarbon value chain, offering a complete range of midstream and marketing solutions. Pembina Pipeline's extensive network of conduits covers some of North America's most prolific basins. The company's mix of transportation and midstream assets include conventional pipelines, oil sands pipelines, transmission pipelines, fractionator and gas processing plant. The company has hydrocarbon transportation capacity, gas processing capacity along with hydrocarbon storage capacity. Pembina divides its operations into three major segments: Pipelines, Facilities, and Marketing & New Ventures. Pembina Pipeline's Divisions includes pipeline transportation, storage, rail services and terminalling. Facilities consists of natural gas fractionation and processing plants among others. Marketing & New Ventures focuses on marketing natural gas liquids to distribution companies..

Number of Employees: 2,997 |

|

|

| |

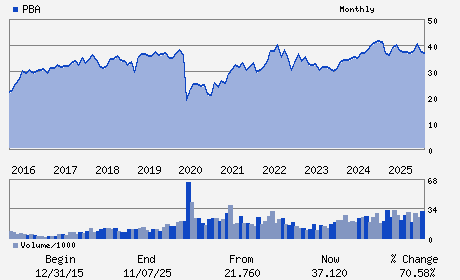

| • Price / Volume Information |

| Yesterday's Closing Price: $43.99 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,647,636 shares |

| Shares Outstanding: 581.09 (millions) |

| Market Capitalization: $25,562.32 (millions) |

| Beta: 0.68 |

| 52 Week High: $44.60 |

| 52 Week Low: $34.13 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.80% |

6.72% |

| 12 Week |

11.20% |

11.06% |

| Year To Date |

15.58% |

15.02% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Scott Burrows - Chief Executive Officer and President

Jaret A. Sprott - Senior Vice President and Chief Operating Officer

Cameron J. Goldade - Senior Vice President and Chief Financial Officer

Christopher S. Scherman - Senior Vice President; Marketing and Strategy Offi

Stuart V. Taylor - Senior Vice President and Corporate Development Of

|

|

Peer Information

Pembina Pipeline Corp. (ENCC.)

Pembina Pipeline Corp. (ENGT)

Pembina Pipeline Corp. (M.PNG)

Pembina Pipeline Corp. (POCC)

Pembina Pipeline Corp. (KPP)

Pembina Pipeline Corp. (MWP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-PROD/PIPELN

Sector: Oils/Energy

CUSIP: 706327103

SIC: 1382

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 581.09

Most Recent Split Date: (:1)

Beta: 0.68

Market Capitalization: $25,562.32 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.62% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.53 |

Indicated Annual Dividend: $2.03 |

| Current Fiscal Year EPS Consensus Estimate: $2.12 |

Payout Ratio: 1.07 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/15/2025 - $0.51 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |