| Zacks Company Profile for Prestige Consumer Healthcare Inc. (PBH : NYSE) |

|

|

| |

| • Company Description |

| Prestige Consumer Healthcare Inc. is a consumer healthcare products company. Its diverse portfolio of brands include Monistat(R) and Summer's Eve(R) women's health products, BC(R) and Goody's(R) pain relievers, Clear Eyes(R) and TheraTears(R) eye care products, DenTek(R) specialty oral care products, Dramamine(R) motion sickness treatments, Fleet(R) enemas and glycerin suppositories, Chloraseptic(R) and Luden's(R) sore throat treatments and drops, Compound W(R) wart treatments, Little Remedies(R) pediatric over-the-counter products, Boudreaux's Butt Paste(R) diaper rash ointments, Nix(R) lice treatment, Debrox(R) earwax remover, Gaviscon(R) antacid in Canada, and Hydralyte(R) rehydration products and the Fess(R) line of nasal and sinus care products in Australia. Prestige Consumer Healthcare Inc., formerly known as Prestige Brands Holdings Inc., is based in Tarrytown, New York.

Number of Employees: 600 |

|

|

| |

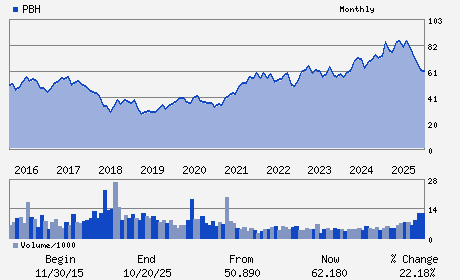

| • Price / Volume Information |

| Yesterday's Closing Price: $69.30 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 429,353 shares |

| Shares Outstanding: 47.32 (millions) |

| Market Capitalization: $3,279.19 (millions) |

| Beta: 0.41 |

| 52 Week High: $90.04 |

| 52 Week Low: $57.25 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.49% |

8.43% |

| 12 Week |

13.94% |

13.80% |

| Year To Date |

12.34% |

11.79% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ronald M. Lombardi - President and Chief Executive Officer

Christine Sacco - Chief Financial Officer & Chief Operating Officer

John E. Byom - Director

Celeste A. Clark - Director

James C. D'Arecca - Director

|

|

Peer Information

Prestige Consumer Healthcare Inc. (BJCT)

Prestige Consumer Healthcare Inc. (CADMQ)

Prestige Consumer Healthcare Inc. (APNO)

Prestige Consumer Healthcare Inc. (UPDC)

Prestige Consumer Healthcare Inc. (IMTIQ)

Prestige Consumer Healthcare Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 74112D101

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 47.32

Most Recent Split Date: (:1)

Beta: 0.41

Market Capitalization: $3,279.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.44 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.54 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |