| Zacks Company Profile for Procter & Gamble Company (The) (PG : NYSE) |

|

|

| |

| • Company Description |

| Procter & Gamble Company, also referred to as P&G, is a branded consumer products company. The company has five reportable segments: Beauty - The segment includes hair care products antiperspirants and deodorants as well as products for personal cleansing and skin care. Grooming - The segment includes Shave Care products like female and male blades & razors and pre- and post-shave products as well as appliances. Health Care - The segment includes gastrointestinal, rapid diagnostics, respiratory, vitamins/minerals/supplements and other personal health care product categories along with toothbrush, toothpaste and other oral care, product categories. Fabric and Home Care - The segment includes air care, dish care, fabric enhancers, laundry additives and detergents, P&G Professional and surface care product categories. Baby, Feminine and Family Care - The segment includes baby wipes, diapers and pants, paper towels, tissues, toilet paper, adult incontinence and feminine care products.

Number of Employees: 109,000 |

|

|

| |

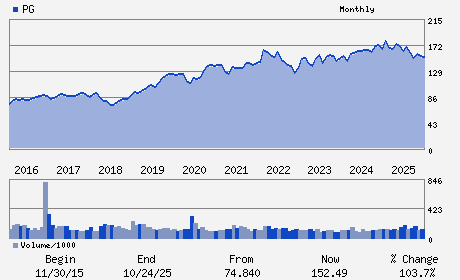

| • Price / Volume Information |

| Yesterday's Closing Price: $167.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 11,100,542 shares |

| Shares Outstanding: 2,324.00 (millions) |

| Market Capitalization: $388,572.91 (millions) |

| Beta: 0.37 |

| 52 Week High: $179.99 |

| 52 Week Low: $137.62 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

10.17% |

11.13% |

| 12 Week |

16.56% |

16.41% |

| Year To Date |

16.67% |

16.10% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jon R. Moeller - Chairman of the Board; President and Chief Executi

Andre Schulten - Chief Financial Officer

Matthew W. Janzaruk - Senior Vice President

B. Marc Allen - Director

Craig Arnold - Director

|

|

Peer Information

Procter & Gamble Company (The) (EPC)

Procter & Gamble Company (The) (HPPS)

Procter & Gamble Company (The) (ADRNY)

Procter & Gamble Company (The) (YHGJ)

Procter & Gamble Company (The) (GPSYY)

Procter & Gamble Company (The) (HENKY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CONS PD- MISC STPL

Sector: Consumer Staples

CUSIP: 742718109

SIC: 2840

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 2,324.00

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.37

Market Capitalization: $388,572.91 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.53% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.57 |

Indicated Annual Dividend: $4.23 |

| Current Fiscal Year EPS Consensus Estimate: $6.97 |

Payout Ratio: 0.61 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 4.29% |

Last Dividend Paid: 01/23/2026 - $1.06 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |