| Zacks Company Profile for Parker-Hannifin Corporation (PH : NYSE) |

|

|

| |

| • Company Description |

| Parker-Hannifin Corporation is a global diversified manufacturer of motion & control technologies and systems. The company provides precision engineered solutions for a wide variety of mobile, industrial and aerospace markets. Their Diversified Industrial Segment is engaged in the production of a wide range of motion-control and fluid systems & components. The products offered by this segment are used in transportation, mobile construction, refrigeration and air conditioning, agriculture and other markets. The segment sells its products through two main channels, namely, original equipment manufacturers (OEMs) and extensive distribution network to smaller OEMs and the aftermarket. Their Aerospace Systems segment supervises the designing and manufacturing of products and also provides aftermarket support for a broad range of aerospace products including commercial, business jet, military and general aviation aircraft and missile.

Number of Employees: 57,950 |

|

|

| |

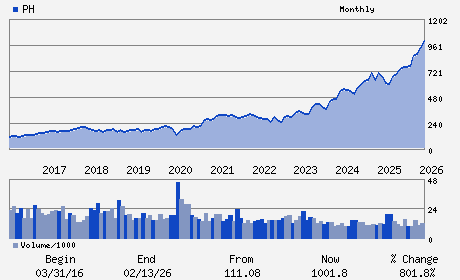

| • Price / Volume Information |

| Yesterday's Closing Price: $1,009.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 646,891 shares |

| Shares Outstanding: 126.22 (millions) |

| Market Capitalization: $127,375.20 (millions) |

| Beta: 1.23 |

| 52 Week High: $1,034.96 |

| 52 Week Low: $488.45 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

7.84% |

8.78% |

| 12 Week |

14.68% |

14.54% |

| Year To Date |

14.81% |

14.26% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6035 PARKLAND BOULEVARD

-

CLEVELAND,OH 44124

USA |

ph: 216-896-3000

fax: 216-896-4000 |

phir@parker.com |

http://www.parker.com |

|

|

| |

| • General Corporate Information |

Officers

Jennifer A. Parmentier - Chairman of the Board and Chief Executive Officer

Andrew D. Ross - President and Chief Operating Officer

Todd M. Leombruno - Executive Vice President and Chief Financial Offic

Mark J. Hart - Executive Vice President

Angela R. Ives - Vice President and Controller

|

|

Peer Information

Parker-Hannifin Corporation (B.)

Parker-Hannifin Corporation (DXPE)

Parker-Hannifin Corporation (AIT)

Parker-Hannifin Corporation (GDI.)

Parker-Hannifin Corporation (CTITQ)

Parker-Hannifin Corporation (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 701094104

SIC: 3490

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 126.22

Most Recent Split Date: 10.00 (1.50:1)

Beta: 1.23

Market Capitalization: $127,375.20 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.71% |

| Current Fiscal Quarter EPS Consensus Estimate: $7.81 |

Indicated Annual Dividend: $7.20 |

| Current Fiscal Year EPS Consensus Estimate: $30.99 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 12.00 |

Change In Payout Ratio: -0.01 |

| Estmated Long-Term EPS Growth Rate: 10.02% |

Last Dividend Paid: 02/06/2026 - $1.80 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |