| Zacks Company Profile for Photronics, Inc. (PLAB : NSDQ) |

|

|

| |

| • Company Description |

| Photronics is a leading worldwide manufacturer of photomasks. Photomasks are high precision quartz plates that contain microscopic images of electronic circuits. A key element in the manufacture of semiconductors and flat panel displays, photomasks are used to transfer circuit patterns onto semiconductor wafers and flat panel substrates during the fabrication of integrated circuits, a variety of flat panel displays and, to a lesser extent, other types of electrical and optical components. They are produced in accordance with product designs provided by customers at strategically located manufacturing facilities in Asia, Europe, and North America.

Number of Employees: 1,908 |

|

|

| |

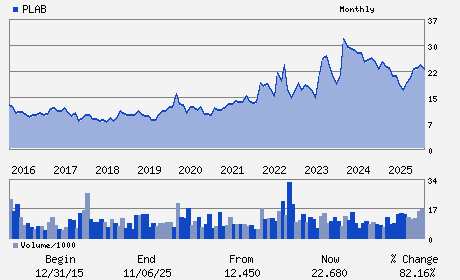

| • Price / Volume Information |

| Yesterday's Closing Price: $37.43 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,177,840 shares |

| Shares Outstanding: 57.92 (millions) |

| Market Capitalization: $2,168.05 (millions) |

| Beta: 1.50 |

| 52 Week High: $45.40 |

| 52 Week Low: $16.46 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.27% |

9.22% |

| 12 Week |

54.99% |

54.80% |

| Year To Date |

16.97% |

16.40% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

George C. Macricostas - Chairman of the Board of Directors and Chief Execu

Eric Rivera - Executive Vice President; Chief Financial Officer

Frank Lee - Director

David A. Garcia - Director

Constantine S. Macricostas - Director

|

|

Peer Information

Photronics, Inc. (PLAB)

Photronics, Inc. (FUJIY)

- (-)

- (-)

- (-)

- (-)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEQPT-PHTOMASK

Sector: Computer and Technology

CUSIP: 719405102

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: October

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/27/26

|

|

Share - Related Items

Shares Outstanding: 57.92

Most Recent Split Date: 12.00 (2.00:1)

Beta: 1.50

Market Capitalization: $2,168.05 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.50 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.20 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/27/26 |

|

|

|

| |