| Zacks Company Profile for Pool Corporation (POOL : NSDQ) |

|

|

| |

| • Company Description |

| Pool Corporation is the world's leading independent distributor of swimming pool equipment, parts and supplies, and other backyard related products. The company operates over 300 locations world wide through three networks: SCP Distributors LLC, Superior Pool Products LLC, and Horizon Distributors Inc. Pool Corporation distributes non-discretionary pool maintenance products, such as chemicals and replacement parts; discretionary products, such as packaged pool kits, whole goods, irrigation and landscape products, including a complete line of commercial and residential irrigation products and parts, power equipment for the professional landscape market; specialty products, which include light fixtures and built-in BBQs; and golf irrigation and water management products. The company serves five types of customers: a) swimming pool remodelers and builders, b) retail swimming pool stores, c) swimming pool repair and service businesses, d) landscape construction and maintenance contractors, and e) golf courses.

Number of Employees: 6,000 |

|

|

| |

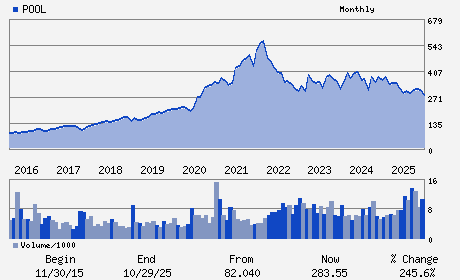

| • Price / Volume Information |

| Yesterday's Closing Price: $227.18 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 963,766 shares |

| Shares Outstanding: 36.79 (millions) |

| Market Capitalization: $8,357.46 (millions) |

| Beta: 1.25 |

| 52 Week High: $374.74 |

| 52 Week Low: $210.67 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.59% |

-9.81% |

| 12 Week |

-5.15% |

-5.27% |

| Year To Date |

-0.69% |

-1.17% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John E. Stokely - Chairman

Peter D. Arvan - President and Chief Executive Officer

Melanie M. Hart - Senior Vice President and Chief Financial Officer

Martha S. Gervasi - Director

James D. Hope - Director

|

|

Peer Information

Pool Corporation (BAJAY)

Pool Corporation (ESCA)

Pool Corporation (GOYL)

Pool Corporation (FTSP)

Pool Corporation (KTO)

Pool Corporation (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: 73278L105

SIC: 5090

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 36.79

Most Recent Split Date: 9.00 (1.50:1)

Beta: 1.25

Market Capitalization: $8,357.46 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.20% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.37 |

Indicated Annual Dividend: $5.00 |

| Current Fiscal Year EPS Consensus Estimate: $11.03 |

Payout Ratio: 0.47 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.15 |

| Estmated Long-Term EPS Growth Rate: 7.26% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |