| Zacks Company Profile for Perma-Pipe International Holdings, Inc. (PPIH : NSDQ) |

|

|

| |

| • Company Description |

| Perma-Pipe International Holdings, Inc. is a manufacturer of pre-insulated piping systems for District Heating and Cooling in North America. The Company offers process, secondary contained, leak detection, steam and condensate piping systems. Perma-Pipe International Holdings Inc., formerly known as MFRI INC., is based in Niles, United States.

Number of Employees: 175 |

|

|

| |

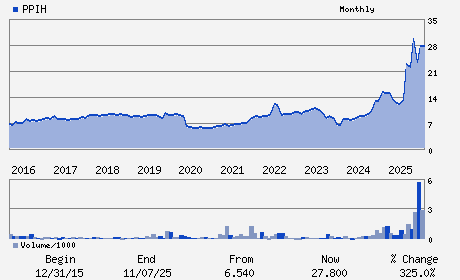

| • Price / Volume Information |

| Yesterday's Closing Price: $32.27 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 92,475 shares |

| Shares Outstanding: 8.09 (millions) |

| Market Capitalization: $261.20 (millions) |

| Beta: 0.49 |

| 52 Week High: $36.48 |

| 52 Week Low: $8.81 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.51% |

10.00% |

| 12 Week |

16.25% |

15.65% |

| Year To Date |

6.29% |

5.73% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David J. Mansfield - Chief Executive Officer

Jerome T. Walker - Chairman

Saleh Sagr - President

Matthew E. Lewicki - Vice President and Chief Financial Officer

Robert Mcnally - Director

|

|

Peer Information

Perma-Pipe International Holdings, Inc. (NSS)

Perma-Pipe International Holdings, Inc. (AIU)

Perma-Pipe International Holdings, Inc. (DBMG)

Perma-Pipe International Holdings, Inc. (PPIH)

Perma-Pipe International Holdings, Inc. (TAM.)

Perma-Pipe International Holdings, Inc. (VMI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: STEEL-PIPE&TUBE

Sector: Industrial Products

CUSIP: 714167103

SIC: 3564

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 8.09

Most Recent Split Date: (:1)

Beta: 0.49

Market Capitalization: $261.20 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |