| Zacks Company Profile for Priority Technology Holdings, Inc. (PRTH : NSDQ) |

|

|

| |

| • Company Description |

| Priority is a solutions provider in Payments and Banking as a Service (BaaS) operating with customers across its SMB, B2B and Enterprise channels. Priority's purpose-built technology enables clients to collect, store, borrow and send while providing customers acceptance of AP payment applications and Passport financial tools that best optimize their cash flow and maximize working capital. The company was founded in 2005 and is headquartered in Alpharetta, Georgia.

Number of Employees: 1,019 |

|

|

| |

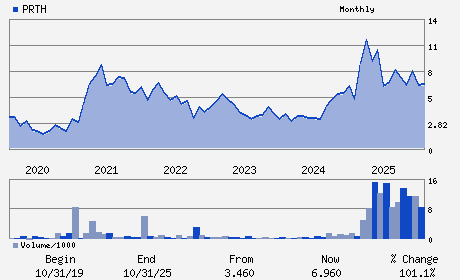

| • Price / Volume Information |

| Yesterday's Closing Price: $5.58 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 361,398 shares |

| Shares Outstanding: 81.87 (millions) |

| Market Capitalization: $456.84 (millions) |

| Beta: 1.45 |

| 52 Week High: $12.47 |

| 52 Week Low: $4.44 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.38% |

-7.64% |

| 12 Week |

-20.63% |

-22.53% |

| Year To Date |

-52.51% |

-59.55% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas C. Priore - Chief Executive Officer and Chairman

Timothy M. O`Leary - Chief Financial Officer

Rajiv Kumar - Senior Vice President and Chief Accounting Officer

John Priore - Director

Michael Passilla - Director

|

|

Peer Information

Priority Technology Holdings, Inc. (EVOL)

Priority Technology Holdings, Inc. (RAMP)

Priority Technology Holdings, Inc. (LGTY)

Priority Technology Holdings, Inc. (ALOT)

Priority Technology Holdings, Inc. (CXT)

Priority Technology Holdings, Inc. (TGHI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Technology Services

Sector: Business Services

CUSIP: 74275G107

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 81.87

Most Recent Split Date: (:1)

Beta: 1.45

Market Capitalization: $456.84 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.29 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.05 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |