| Zacks Company Profile for PriceSmart, Inc. (PSMT : NSDQ) |

|

|

| |

| • Company Description |

| PriceSmart, Inc. is primarily engaged in the operation of membership shopping warehouses in international markets. The company's business consists of international membership shopping stores similar to, but smaller in size than, warehouse clubs in the United States. The warehouses sell basic consumer goods with an emphasis on quality, low prices and efficient operations. By offering low prices on brand name and private label merchandise, the warehouses seek to generate sufficient sales volumes to operate profitably at relatively low gross margins.

Number of Employees: 12,000 |

|

|

| |

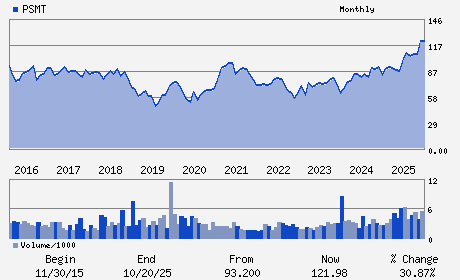

| • Price / Volume Information |

| Yesterday's Closing Price: $154.62 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 196,346 shares |

| Shares Outstanding: 30.82 (millions) |

| Market Capitalization: $4,764.68 (millions) |

| Beta: 0.73 |

| 52 Week High: $158.01 |

| 52 Week Low: $81.35 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

8.73% |

9.68% |

| 12 Week |

20.81% |

20.66% |

| Year To Date |

26.05% |

25.43% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David N. Price - Chief Executive Officer and Director

Robert E. Price - Executive Chairman

David R. Snyder - Vice Chairman

Gualberto Hernandez - Executive Vice President and Chief Financial Offic

Sherry S. Bahrambeygui - Director

|

|

Peer Information

PriceSmart, Inc. (TGT)

PriceSmart, Inc. (BURL)

PriceSmart, Inc. (ALCSQ)

PriceSmart, Inc. (CLDRQ)

PriceSmart, Inc. (BLEEQ)

PriceSmart, Inc. (FDO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-DISCOUNT

Sector: Retail/Wholesale

CUSIP: 741511109

SIC: 5331

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/08/26

|

|

Share - Related Items

Shares Outstanding: 30.82

Most Recent Split Date: (:1)

Beta: 0.73

Market Capitalization: $4,764.68 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.91% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.40 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.26 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.01 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/17/2026 - $0.70 |

| Next EPS Report Date: 04/08/26 |

|

|

|

| |