| Zacks Company Profile for QNB Corp. (QNBC : OTC) |

|

|

| |

| • Company Description |

| QNB Corp. operates as the holding company for QNB Bank that provides commercial and retail banking, and retail brokerage services in eastern Pennsylvania. The Bank is engaged in the general commercial banking business and provides a range of banking services to its customers. It offers time deposits, including certificates of deposit and individual retirement accounts; demand deposits; and savings accounts that include money market accounts, club accounts, interest-bearing demand accounts, and traditional statement savings accounts. The company's loan portfolio comprises commercial loans, residential mortgage loans, and consumer loans, as well as engages in purchasing investment securities. Headquartered in Quakertown, Pennsylvania, the company has banking offices in Bucks, Montgomery, and Lehigh counties in the southeastern Pennsylvania.

Number of Employees: 198 |

|

|

| |

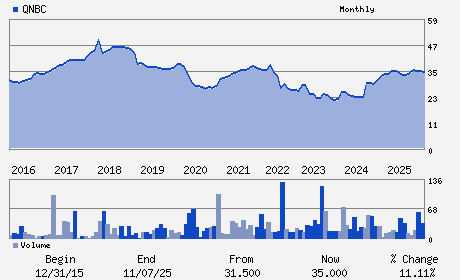

| • Price / Volume Information |

| Yesterday's Closing Price: $37.25 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,990 shares |

| Shares Outstanding: 3.76 (millions) |

| Market Capitalization: $140.12 (millions) |

| Beta: 0.45 |

| 52 Week High: $38.69 |

| 52 Week Low: $32.16 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.69% |

0.18% |

| 12 Week |

5.52% |

5.39% |

| Year To Date |

6.52% |

6.00% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

15 NORTH THIRD STREET P.O. BOX 9005

-

QUAKERTOWN,PA 18951

USA |

ph: 215-538-5600

fax: 215-538-5765 |

None |

http://www.qnbbank.com |

|

|

| |

| • General Corporate Information |

Officers

David W. Freeman - Chief Executive Officer; Principal Executive Offic

Randy S. Bimes - Director; Chairman

Jeffrey Lehocky - Chief Financial Officer

Mary E. Liddle - Chief Accounting Officer

Autumn R. Bayles - Director

|

|

Peer Information

QNB Corp. (CNBKA)

QNB Corp. (CNBI2)

QNB Corp. (CNOB)

QNB Corp. (FBNK.)

QNB Corp. (FMBN)

QNB Corp. (TBNK)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-NORTHEAST

Sector: Finance

CUSIP: 74726N107

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/28/26

|

|

Share - Related Items

Shares Outstanding: 3.76

Most Recent Split Date: (:1)

Beta: 0.45

Market Capitalization: $140.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.08% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $1.52 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.38 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/12/2025 - $0.38 |

| Next EPS Report Date: 04/28/26 |

|

|

|

| |