| Zacks Company Profile for Quad Graphics, Inc (QUAD : NYSE) |

|

|

| |

| • Company Description |

| Quad/Graphics, Inc. provide marketing solution. The company offer a comprehensive range of marketing and print services which seamlessly integrate creative, production and media solutions across online and offline channels. Quad/Graphics, Inc. is based in SUSSEX, Wis.

Number of Employees: 10,100 |

|

|

| |

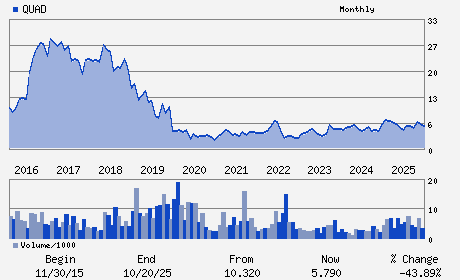

| • Price / Volume Information |

| Yesterday's Closing Price: $6.88 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 230,198 shares |

| Shares Outstanding: 52.26 (millions) |

| Market Capitalization: $359.58 (millions) |

| Beta: 1.09 |

| 52 Week High: $7.54 |

| 52 Week Low: $4.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.38% |

10.89% |

| 12 Week |

13.16% |

12.58% |

| Year To Date |

9.73% |

9.15% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

N61 W23044 HARRY`S WAY

-

SUSSEX,WI 53089

USA |

ph: 414-566-6000

fax: 414-566-4650 |

ir@quad.com |

http://www.quad.com |

|

|

| |

| • General Corporate Information |

Officers

J. Joel Quadracci - Chairman and Chief Executive Officer

David J. Honan - President and Chief Operating Officer

Anthony C. Staniak - Chief Financial Officer and Treasurer

Julie A. Currie - Executive Vice President and Chief Revenue Officer

Kelly A. Vanderboom - Executive Vice President and Head of Agency Operat

|

|

Peer Information

Quad Graphics, Inc (IBDI)

Quad Graphics, Inc (VAPR)

Quad Graphics, Inc (SWWI)

Quad Graphics, Inc (GREY)

Quad Graphics, Inc (JCDXF)

Quad Graphics, Inc (GMIG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ADVERTISING/MKTG SVCS

Sector: Business Services

CUSIP: 747301109

SIC: 2750

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 52.26

Most Recent Split Date: (:1)

Beta: 1.09

Market Capitalization: $359.58 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 5.81% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.22 |

Indicated Annual Dividend: $0.40 |

| Current Fiscal Year EPS Consensus Estimate: $1.18 |

Payout Ratio: 0.30 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.17 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/27/2026 - $0.10 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |