| Zacks Company Profile for Rave Restaurant Group, Inc. (RAVE : NSDQ) |

|

|

| |

| • Company Description |

| RAVE Restaurant Group, Inc. operates and franchises pizza buffet, delivery/carry-out and express restaurants domestically and internationally under the trademark Pizza Inn and Pie Five Pizza Company (Pie Five). Pie Five offers individual handcrafted pizzas with fresh ingredients made to order in less than five minutes. Pizza Inn is an international chain featuring freshly made traditional and specialty pizzas, salads, pastas, sandwiches and desserts. RAVE Restaurant Group, Inc., formerly known as Pizza Inn Holdings, Inc., is based in Dallas.

Number of Employees: 24 |

|

|

| |

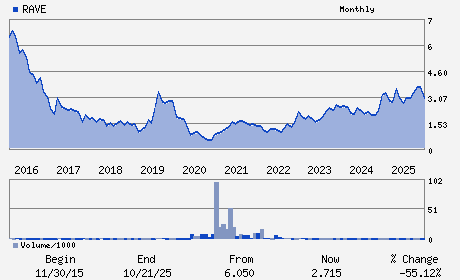

| • Price / Volume Information |

| Yesterday's Closing Price: $2.95 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 25,940 shares |

| Shares Outstanding: 14.21 (millions) |

| Market Capitalization: $41.92 (millions) |

| Beta: 0.36 |

| 52 Week High: $3.75 |

| 52 Week Low: $2.01 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-11.68% |

-10.90% |

| 12 Week |

1.37% |

1.25% |

| Year To Date |

-10.61% |

-11.04% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Brandon L. Solano - Chief Executive Officer

Mark E. Schwarz - Chairman of the Board and Director

Robert B. Page - Director

William C. Hammett, Jr. - Director

Clinton J. Coleman - Director

|

|

Peer Information

Rave Restaurant Group, Inc. (BH)

Rave Restaurant Group, Inc. (BUCA)

Rave Restaurant Group, Inc. (BUNZQ)

Rave Restaurant Group, Inc. (FRRG)

Rave Restaurant Group, Inc. (CHEF.)

Rave Restaurant Group, Inc. (BGMTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-RESTRNTS

Sector: Retail/Wholesale

CUSIP: 754198109

SIC: 5140

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 14.21

Most Recent Split Date: (:1)

Beta: 0.36

Market Capitalization: $41.92 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |