| Zacks Company Profile for RadNet, Inc. (RDNT : NSDQ) |

|

|

| |

| • Company Description |

| RadNet, Inc., is a national market leader providing high-quality, cost-effective diagnostic imaging services through a network of fully-owned and operated outpatient imaging centers. RadNet offers to its patients and referring physicians the full spectrum of diagnostic imaging exams, including PET/CT, MRI, CT, Nuclear Medicine, Mammography, Ultrasound and X-ray, as well as numerous other procedures. RadNet utilizes best of breed technology to appropriately serve the medical communities in which it operates.

Number of Employees: 11,021 |

|

|

| |

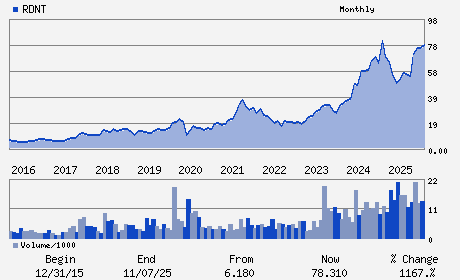

| • Price / Volume Information |

| Yesterday's Closing Price: $75.22 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 794,175 shares |

| Shares Outstanding: 77.15 (millions) |

| Market Capitalization: $5,802.95 (millions) |

| Beta: 1.49 |

| 52 Week High: $85.84 |

| 52 Week Low: $45.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.14% |

7.60% |

| 12 Week |

-1.23% |

-1.74% |

| Year To Date |

5.42% |

4.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Howard G. Berger - Chief Executive Officer and President

Mark D. Stolper - Chief Financial Officer

Gregory E. Spurlock - Director

Alma Gregory Sorensen - Director

David L. Swartz - Director

|

|

Peer Information

RadNet, Inc. (CMTI)

RadNet, Inc. (CMWLQ)

RadNet, Inc. (AHG.)

RadNet, Inc. (ROIX)

RadNet, Inc. (M.DCE)

RadNet, Inc. (DHSM)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-OUTP/HM CRE

Sector: Medical

CUSIP: 750491102

SIC: 8071

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 77.15

Most Recent Split Date: (:1)

Beta: 1.49

Market Capitalization: $5,802.95 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.12 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.73 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |