| Zacks Company Profile for Regeneron Pharmaceuticals, Inc. (REGN : NSDQ) |

|

|

| |

| • Company Description |

| Regeneron is a biotechnology company focused on the discovery, development and commercialization of treatments targeting serious medical conditions. The company's portfolio boasts nine marketed drugs - Eylea, Dupixent, Praluent, Kevzara, Libtayo, Evkeeza, Inmazeb Arcalyst and Zaltrap. The company also developed an antibody cocktail for COVID-19, REGEN-COV. REGEN-COV is a cocktail of two monoclonal antibodies and was designed specifically to block the infectivity of SARS-CoV-2, the virus that causes COVID-19. Regeneron has a collaboration agreement with Roche for the same. While Regeneron has co-developed Eylea with Bayer's HealthCare unit, Praluent was co-developed with Sanofi. Regeneron collaborated with Bayer for the joint development and commercialization of co-formulated combinations of Eylea, rinucumab and nesvacumab for the treatment of ocular diseases or disorders outside the United States.

Number of Employees: 15,410 |

|

|

| |

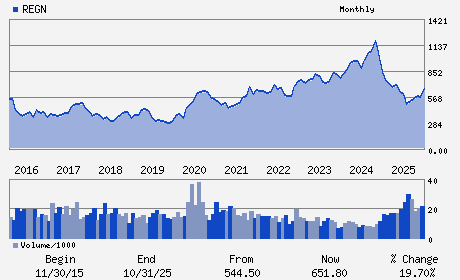

| • Price / Volume Information |

| Yesterday's Closing Price: $781.67 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 714,372 shares |

| Shares Outstanding: 105.72 (millions) |

| Market Capitalization: $82,638.00 (millions) |

| Beta: 0.40 |

| 52 Week High: $821.11 |

| 52 Week Low: $476.49 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.42% |

6.35% |

| 12 Week |

8.81% |

8.68% |

| Year To Date |

1.27% |

0.78% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Leonard S. Schleifer - Chief Executive Officer; Board co-Chair and Presi

George D. Yancopoulos - Board co-Chair; President and Chief Scientific Of

Christopher Fenimore - Executive Vice President; Finance and Chief Finan

Jason Pitofsky - Vice President; Controller

Bonnie L. Bassler - Director

|

|

Peer Information

Regeneron Pharmaceuticals, Inc. (CORR.)

Regeneron Pharmaceuticals, Inc. (RSPI)

Regeneron Pharmaceuticals, Inc. (CGXP)

Regeneron Pharmaceuticals, Inc. (BGEN)

Regeneron Pharmaceuticals, Inc. (GTBP)

Regeneron Pharmaceuticals, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 75886F107

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 105.72

Most Recent Split Date: (:1)

Beta: 0.40

Market Capitalization: $82,638.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.48% |

| Current Fiscal Quarter EPS Consensus Estimate: $5.96 |

Indicated Annual Dividend: $3.76 |

| Current Fiscal Year EPS Consensus Estimate: $34.88 |

Payout Ratio: 0.10 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.08 |

| Estmated Long-Term EPS Growth Rate: 10.67% |

Last Dividend Paid: 02/20/2026 - $0.94 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |