| Zacks Company Profile for RELX PLC (RELX : NYSE) |

|

|

| |

| • Company Description |

| Relx PLC is engaged in providing information solutions. Its products and services comprise intellectual property content delivered through various media, including online, journals and books. The Company's operating segments consists of Scientific, Technical & Medical, Risk & Business Information; Legal and Exhibitions. RELX PLC, formerly known as Reed Elsevier PLC, is based in LONDON, United Kingdom.

Number of Employees: 36,400 |

|

|

| |

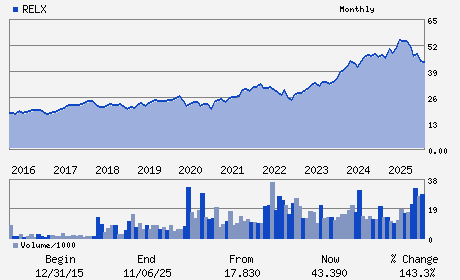

| • Price / Volume Information |

| Yesterday's Closing Price: $34.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,790,125 shares |

| Shares Outstanding: 1,818.06 (millions) |

| Market Capitalization: $63,250.40 (millions) |

| Beta: 0.77 |

| 52 Week High: $56.33 |

| 52 Week Low: $27.57 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.82% |

-1.97% |

| 12 Week |

-13.72% |

-13.82% |

| Year To Date |

-13.93% |

-14.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Erik Engstrom - Chief Executive Officer

Paul Walker - Chairman

Nick Luff - Chief Financial Officer

Robert MacLeod - Director

Andrew Sukawaty - Director

|

|

Peer Information

RELX PLC (HHNT)

RELX PLC (CDCAQ)

RELX PLC (IPIXQ)

RELX PLC (CNET.)

RELX PLC (DTHK)

RELX PLC (ADAM.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET CONTENT

Sector: Computer and Technology

CUSIP: 759530108

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 1,818.06

Most Recent Split Date: 7.00 (4.00:1)

Beta: 0.77

Market Capitalization: $63,250.40 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.52% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.53 |

| Current Fiscal Year EPS Consensus Estimate: $1.97 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 9.94% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |