| Zacks Company Profile for ReTo Eco-Solutions, Inc. (RETO : NSDQ) |

|

|

| |

| • Company Description |

| Reto Eco-Solutions, Inc. is a manufacturer and distributor of construction materials, made from mining waste and fly-ash, as well as equipment for the production of construction materials. The Company also provides project solutions including consultation, design, project implementation and construction. It operates primarily in China, Canada, the United States, Mongolia, Middle East, India, South Asia, North Africa and Brazil. Reto Eco-Solutions, Inc. is headquartered in Beijing.

Number of Employees: 46 |

|

|

| |

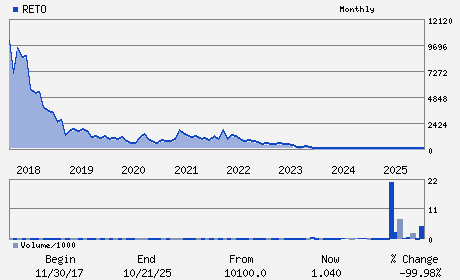

| • Price / Volume Information |

| Yesterday's Closing Price: $0.90 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,743,759 shares |

| Shares Outstanding: 2.86 (millions) |

| Market Capitalization: $2.57 (millions) |

| Beta: 1.48 |

| 52 Week High: $53.50 |

| 52 Week Low: $0.55 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.72% |

-7.92% |

| 12 Week |

-76.14% |

-76.17% |

| Year To Date |

-52.88% |

-53.11% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

X-702 60 ANLI ROAD CHAOYANG DISTRICT

-

BEIJING,F4 100101

CHN |

ph: 86-10-6482-7328

fax: - |

ir@retoeco.com |

http://www.retoeco.com |

|

|

| |

| • General Corporate Information |

Officers

Hengfang Li - Chief Executive Officer and Chairman

Guangfeng Dai - President; Chief Operating Officer and Director

Yue Hu - Chief Financial Officer

Tonglong Liu - Director

Baoqing Sun - Director

|

|

Peer Information

ReTo Eco-Solutions, Inc. (DEVC)

ReTo Eco-Solutions, Inc. (CMTOY)

ReTo Eco-Solutions, Inc. (CEMTY)

ReTo Eco-Solutions, Inc. (T.LCI)

ReTo Eco-Solutions, Inc. (CNR.1)

ReTo Eco-Solutions, Inc. (HAN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-CMT/CNT/AG

Sector: Construction

CUSIP: G75271133

SIC: 3290

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 2.86

Most Recent Split Date: 11.00 (0.20:1)

Beta: 1.48

Market Capitalization: $2.57 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |