| Zacks Company Profile for Regions Financial Corporation (RF : NYSE) |

|

|

| |

| • Company Description |

| Regions Financial Corp., a financial holding company, provides retail and commercial and mortgage banking, as well as other financial services in the asset management, wealth management, securities brokerage, trust services, mergers and acquisitions advisory services and other specialty financing across the South, Midwest and Texas. The company has 4 business segments. The Corporate Bank segment includes the company's commercial banking functions including commercial and industrial, commercial real estate, investor real estate lending, equipment lease financing and capital market activities. The Consumer Bank segment comprises the company's branch network, including consumer banking products and services as well as the corresponding deposit relationships. The Wealth Management segment provides investment advice, assistance in managing assets and estate planning to individuals and institutional clients. Other includes the company's treasury function, the securities portfolio, wholesale funding activities, etc.

Number of Employees: 19,969 |

|

|

| |

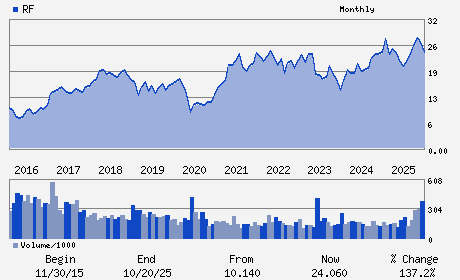

| • Price / Volume Information |

| Yesterday's Closing Price: $27.83 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 13,482,096 shares |

| Shares Outstanding: 863.51 (millions) |

| Market Capitalization: $24,031.39 (millions) |

| Beta: 1.02 |

| 52 Week High: $31.53 |

| 52 Week Low: $17.74 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-2.35% |

-1.50% |

| 12 Week |

5.90% |

5.77% |

| Year To Date |

2.69% |

2.20% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1900 FIFTH AVENUE NORTH

-

BIRMINGHAM,AL 35203

USA |

ph: 800-734-4667

fax: 334-832-8419 |

None |

http://www.regions.com |

|

|

| |

| • General Corporate Information |

Officers

John M. Turner, Jr. - Chairman; President and Chief Executive Officer

David J. Turner, Jr. - Senior Executive Vice President and Chief Financia

Karin K. Allen - Executive Vice President and Assistant Controller

Mark A. Crosswhite - Director

Noopur Davis - Director

|

|

Peer Information

Regions Financial Corporation (TSFG)

Regions Financial Corporation (ABCB)

Regions Financial Corporation (CFNL)

Regions Financial Corporation (CPKF)

Regions Financial Corporation (HIB)

Regions Financial Corporation (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 7591EP100

SIC: 6021

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/16/26

|

|

Share - Related Items

Shares Outstanding: 863.51

Most Recent Split Date: 7.00 (1.24:1)

Beta: 1.02

Market Capitalization: $24,031.39 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.81% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.61 |

Indicated Annual Dividend: $1.06 |

| Current Fiscal Year EPS Consensus Estimate: $2.61 |

Payout Ratio: 0.45 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: 10.83% |

Last Dividend Paid: 12/01/2025 - $0.26 |

| Next EPS Report Date: 04/16/26 |

|

|

|

| |