| Zacks Company Profile for Reinsurance Group of America, Incorporated (RGA : NYSE) |

|

|

| |

| • Company Description |

| Reinsurance Group of America, Inc. is one of the largest global life and health reinsurance companies. It is the only global reinsurance company to focus primarily on life- and health-related reinsurance solutions. Its core products and services include life reinsurance, living benefits reinsurance, group reinsurance, health reinsurance, financial solutions, facultative underwriting, and product development. It provides Traditional reinsurance includes individual and group life and health, disability, and critical illness reinsurance. Life reinsurance refers to reinsurance of individual or group-issued term, whole life, universal life, and joint and last survivor insurance policies. Health & disability reinsurance refers to reinsurance of individual or group health policies. Critical illness reinsurance provides a benefit in the event of the diagnosis of a pre-defined critical illness. It has 4 geographic segments: U.S. & Latin America; Canada Operations; Europe, Middle East and Africa; and Asia Pacific.

Number of Employees: 4,300 |

|

|

| |

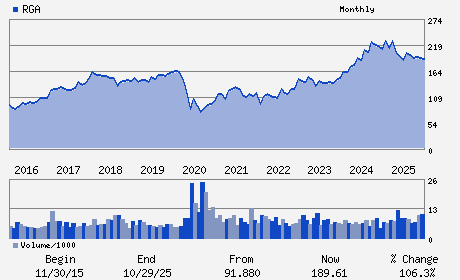

| • Price / Volume Information |

| Yesterday's Closing Price: $215.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 483,464 shares |

| Shares Outstanding: 65.56 (millions) |

| Market Capitalization: $14,143.94 (millions) |

| Beta: 0.50 |

| 52 Week High: $229.21 |

| 52 Week Low: $159.25 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.40% |

7.33% |

| 12 Week |

11.92% |

11.78% |

| Year To Date |

6.03% |

5.52% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Tony Cheng - Chief Executive Officer;President

Stephen T. O'Hearn - Chair of the Board and Director

Axel Andre - Executive Vice President and Chief Financial Offic

Pina Albo - Director

Michele M. Bang - Director

|

|

Peer Information

Reinsurance Group of America, Incorporated (AGC.)

Reinsurance Group of America, Incorporated (T.GWO)

Reinsurance Group of America, Incorporated (AMH.2)

Reinsurance Group of America, Incorporated (CSLI.)

Reinsurance Group of America, Incorporated (CIA)

Reinsurance Group of America, Incorporated (DFG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-LIFE

Sector: Finance

CUSIP: 759351604

SIC: 6311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 65.56

Most Recent Split Date: 3.00 (1.50:1)

Beta: 0.50

Market Capitalization: $14,143.94 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.72% |

| Current Fiscal Quarter EPS Consensus Estimate: $6.07 |

Indicated Annual Dividend: $3.72 |

| Current Fiscal Year EPS Consensus Estimate: $25.77 |

Payout Ratio: 0.15 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.29 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/17/2026 - $0.93 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |