| Zacks Company Profile for Royal Gold, Inc. (RGLD : NSDQ) |

|

|

| |

| • Company Description |

| Royal Gold, together with its subsidiaries, acquires and manages precious metals stream and royalty interests, with a primary focus on gold. Royal Gold manages its business under two segments: Acquisition and Management of Stream Interests. A metal stream is a purchase agreement that provides, in exchange for an upfront deposit payment, the right to purchase all or a portion of one or more metals produced from a mine, at a price determined for the life of the transaction by the purchase agreement. Acquisition and Management of Royalty Interests - Royalties are non-operating interests in mining projects which provide the right to revenues or metals produced from the project after deducting specified costs, if any. Royal Gold entered into a silver mine life purchase agreement with Khoemacau Copper Mining Limited, subsidiary of Cupric Canyon Capital LP. The agreement highlights the purchase and sale of silver, produced from the Khoemacau Copper Project in Botswana.

Number of Employees: 39 |

|

|

| |

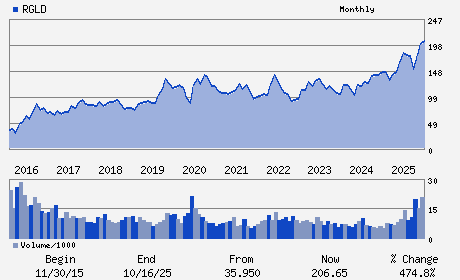

| • Price / Volume Information |

| Yesterday's Closing Price: $299.79 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 888,726 shares |

| Shares Outstanding: 84.81 (millions) |

| Market Capitalization: $25,425.22 (millions) |

| Beta: 0.47 |

| 52 Week High: $306.25 |

| 52 Week Low: $146.88 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

13.85% |

14.85% |

| 12 Week |

48.66% |

48.48% |

| Year To Date |

34.86% |

34.21% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

William Heissenbuttel - Chief Executive Officer; President

William Hayes - Chairman

Paul Libner - Senior Vice President and Chief Financial Officer

Fabiana Chubbs - Director

Mark Isto - Director

|

|

Peer Information

Royal Gold, Inc. (MDWCQ)

Royal Gold, Inc. (JABI)

Royal Gold, Inc. (DRD)

Royal Gold, Inc. (SDMCF)

Royal Gold, Inc. (BENGF)

Royal Gold, Inc. (GBGLF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MINING -GOLD

Sector: Basic Materials

CUSIP: 780287108

SIC: 6795

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 84.81

Most Recent Split Date: (:1)

Beta: 0.47

Market Capitalization: $25,425.22 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.63% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.99 |

Indicated Annual Dividend: $1.90 |

| Current Fiscal Year EPS Consensus Estimate: $12.51 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.11 |

| Estmated Long-Term EPS Growth Rate: 13.26% |

Last Dividend Paid: 01/02/2026 - $0.47 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |