| Zacks Company Profile for Roche Holding AG (RHHBY : OTC) |

|

|

| |

| • Company Description |

| Basel, Switzerland-based Roche Holding Ltd. is a leading health care company focused on developing and commercializing innovative diagnostic and therapeutic products and services, which enable early detection and prevention of diseases as well as their treatment and monitoring. The company conducts its operations through two segments ' Pharmaceuticals and Diagnostics.Pharmaceuticals: Key focus areas in this segment include Oncology, Virology, Inflammation, Metabolism and Neuroscience. Diagnostics: The Diagnostics Division operates in four segments ' Roche Professional Diagnostics, Roche Diabetes Care, Roche Molecular Diagnostics, and Roche Tissue Diagnostics. In September 2014, Roche acquired InterMune for $8.3 billion and added Esbriet to its portfolio. During the first quarter of 2018, Roche acquired Flatiron Health and Ignyta, Inc.

Number of Employees: 103,249 |

|

|

| |

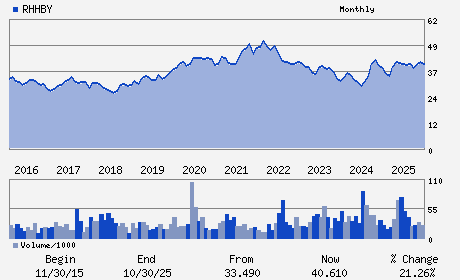

| • Price / Volume Information |

| Yesterday's Closing Price: $57.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,627,334 shares |

| Shares Outstanding: 6,370.54 (millions) |

| Market Capitalization: $368,663.00 (millions) |

| Beta: 0.44 |

| 52 Week High: $60.85 |

| 52 Week Low: $34.75 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.31% |

2.71% |

| 12 Week |

18.34% |

17.74% |

| Year To Date |

12.22% |

11.63% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Thomas Schinecker - Chief Executive Officer

Severin Schwan - Chairman

Andre Hoffmann - Vice-Chairman

Alan Hippe - Chief Financial Officer

Patrick Frost - Director

|

|

Peer Information

Roche Holding AG (AGN.)

Roche Holding AG (NVS)

Roche Holding AG (NVO)

Roche Holding AG (LLY)

Roche Holding AG (RHHBY)

Roche Holding AG (JNJ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Large Cap Pharma

Sector: Medical

CUSIP: 771195104

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 6,370.54

Most Recent Split Date: 2.00 (2.00:1)

Beta: 0.44

Market Capitalization: $368,663.00 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.51% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.87 |

| Current Fiscal Year EPS Consensus Estimate: $3.16 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 4.51% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |