| Zacks Company Profile for Gibraltar Industries, Inc. (ROCK : NSDQ) |

|

|

| |

| • Company Description |

| Gibraltar Industries Inc. manufactures and distributes products to the industrial and buildings market globally through wholesalers, retail home centers, residential, commercial and transportation contractors. The products range from ventilation and expanded metal to mail storage solutions and rain dispersion products and solutions. The company has 4 operating segments. Residential segment includes rain dispersion, roof and ventilation products, both single and cluster units, trims and flashings for single and multifamily residences, mail storage and low rise commercial buildings. Infrastructure segment includes bridge bearings and roadway expansion joints, bar grating and expanded and perforated metals. Renewable segment focuses on designing, engineering, manufacturing, and installation of solar racking and electrical balance of systems. Agtech segment offers commercial greenhouse growing and plant processing solutions as well as installation of commercial greenhouses, and botanical oil extraction systems.

Number of Employees: 2,300 |

|

|

| |

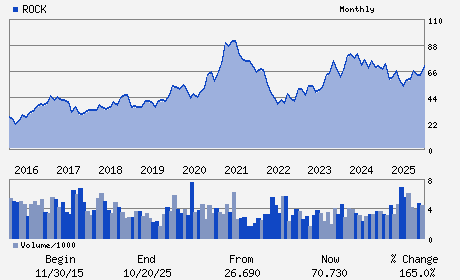

| • Price / Volume Information |

| Yesterday's Closing Price: $45.48 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 224,055 shares |

| Shares Outstanding: 29.55 (millions) |

| Market Capitalization: $1,343.80 (millions) |

| Beta: 1.34 |

| 52 Week High: $75.08 |

| 52 Week Low: $42.86 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-11.28% |

-10.50% |

| 12 Week |

-7.79% |

-7.90% |

| Year To Date |

-8.01% |

-8.46% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

William T. Bosway - Chief Executive Officer; Chairman of the Board and

Joseph A. Lovechio - Vice President and Chief Financial Officer

Atlee Valentine Pope - Lead Independent Director

Mark G. Barberio - Director

James S. Metcalf - Director

|

|

Peer Information

Gibraltar Industries, Inc. (CSRLY)

Gibraltar Industries, Inc. (ARRD)

Gibraltar Industries, Inc. (CGMCQ)

Gibraltar Industries, Inc. (CMCJY)

Gibraltar Industries, Inc. (OMRP)

Gibraltar Industries, Inc. (ABLT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG&CONST-MISC

Sector: Construction

CUSIP: 374689107

SIC: 3310

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 29.55

Most Recent Split Date: 11.00 (1.50:1)

Beta: 1.34

Market Capitalization: $1,343.80 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.83 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $3.85 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 15.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |