| Zacks Company Profile for Rockwell Automation, Inc. (ROK : NYSE) |

|

|

| |

| • Company Description |

| Rockwell Automation provides industrial automation and information solutions worldwide. The company has a wide network spanning globally. Its brands include Rockwell Automation, Allen-Bradley and Rockwell Software. Rockwell Automation reports results based on three operating segments: Intelligent Devices, Software & Control, and Lifecycle Services. Major markets served by the company consist of discrete end markets. Hybrid end markets including Food & Beverage, Life Sciences and Household and Personal Care, among others. Process end markets such as Oil & Gas, Metals, Chemicals, Pulp & Paper, to name a few. Intelligent Devices segment includes drives, motion, safety, sensing, industrial components. Software & Control includes control and visualization software and hardware, information software, and network and security infrastructure. Lifecycle Services includes consulting, professional services and solutions, connected services, and maintenance services, and the Sensia joint venture.

Number of Employees: 26,000 |

|

|

| |

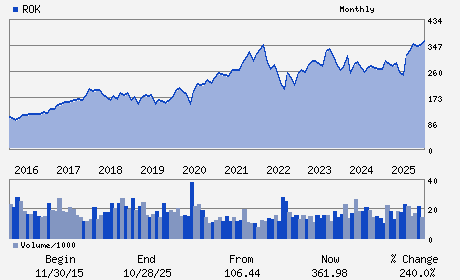

| • Price / Volume Information |

| Yesterday's Closing Price: $407.45 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,327,033 shares |

| Shares Outstanding: 112.36 (millions) |

| Market Capitalization: $45,780.23 (millions) |

| Beta: 1.53 |

| 52 Week High: $438.72 |

| 52 Week Low: $215.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.37% |

-2.52% |

| 12 Week |

0.78% |

0.66% |

| Year To Date |

4.72% |

4.22% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Blake D. Moret - Chief Executive Officer;Chairman of the Board; Pre

Christian E. Rothe - Senior Vice President and Chief Financial Officer

William P. Gipson - Director

Alice L. Jolla - Director

James P. Keane - Director

|

|

Peer Information

Rockwell Automation, Inc. (REFR)

Rockwell Automation, Inc. (BELFA)

Rockwell Automation, Inc. (DIPC)

Rockwell Automation, Inc. (V.SSC)

Rockwell Automation, Inc. (BNSOF)

Rockwell Automation, Inc. (CUB.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PRODS-MISC

Sector: Computer and Technology

CUSIP: 773903109

SIC: 3829

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 112.36

Most Recent Split Date: 4.00 (2.00:1)

Beta: 1.53

Market Capitalization: $45,780.23 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.35% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.90 |

Indicated Annual Dividend: $5.52 |

| Current Fiscal Year EPS Consensus Estimate: $12.13 |

Payout Ratio: 0.49 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 11.54% |

Last Dividend Paid: 02/23/2026 - $1.38 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |