| Zacks Company Profile for Rollins, Inc. (ROL : NYSE) |

|

|

| |

| • Company Description |

| Rollins provides pest and termite control services to residential and commercial customers. The company offers protection against termite damage, insects and rodents to homes and businesses, including food manufacturers, food service establishments, hotels, transportation companies and retailers. Rollins also offers pest management and sanitation products and services to food and commodity industries; consulting services on border protection related to Australia's biosecurity program; and bird control and specialist services. It offers specialized services to mining, and oil and gas sectors. The company's offerings also include mosquito control, wildlife, lawn care insurance and HVAC services. Rollins operates through wholly-owned subsidiaries in North America, Australia and Europe. The company has international franchises in Central America, the Caribbean, the Middle East, the Mediterranean, Europe, Asia, Africa, Australia, Canada and Mexico.

Number of Employees: 21,946 |

|

|

| |

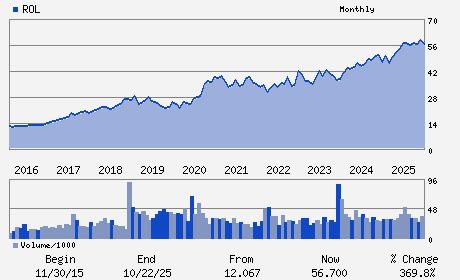

| • Price / Volume Information |

| Yesterday's Closing Price: $60.89 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,949,686 shares |

| Shares Outstanding: 481.09 (millions) |

| Market Capitalization: $29,293.71 (millions) |

| Beta: 0.80 |

| 52 Week High: $66.14 |

| 52 Week Low: $49.73 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.87% |

-3.03% |

| 12 Week |

-0.83% |

-0.95% |

| Year To Date |

1.45% |

0.96% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jerry E. Gahlhoff, Jr. - Chief Executive Officer and President

John F. Wilson - Executive Chairman of the Board

Kenneth D. Krause - Chief Financial Officer and Executive Vice Preside

William W. Harkins - Chief Accounting Officer

Susan R. Bell - Director

|

|

Peer Information

Rollins, Inc. (DWYR)

Rollins, Inc. (ESR.)

Rollins, Inc. (SNR.)

Rollins, Inc. (TISI)

Rollins, Inc. (HWRK)

Rollins, Inc. (SWSH.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG-MAINT & SV

Sector: Construction

CUSIP: 775711104

SIC: 7340

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 481.09

Most Recent Split Date: 12.00 (1.50:1)

Beta: 0.80

Market Capitalization: $29,293.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.20% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.24 |

Indicated Annual Dividend: $0.73 |

| Current Fiscal Year EPS Consensus Estimate: $1.24 |

Payout Ratio: 0.65 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: 13.09% |

Last Dividend Paid: 02/25/2026 - $0.18 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |