| Zacks Company Profile for Ross Stores, Inc. (ROST : NSDQ) |

|

|

| |

| • Company Description |

| Ross Stores Inc. operates as an off-price retailer of apparel and home accessories, primarily in the United States. The company operates its stores under the Ross Dress for Less (Ross) and dd's DISCOUNTS names. The company's stores are located mostly in community and neighborhood shopping centers in heavily populated urban and suburban areas. Ross Stores primarily offers in-season, branded, and designer apparel, footwear, accessories and other home-related merchandise for everyone in the family. This format primarily targets middle-income households. Prices offered at Ross are generally 20% to 60% below the regular prices of most department and specialty stores. dd's DISCOUNTS features more moderately-priced first-quality, in-season, name brand apparel, accessories, footwear, and home fashions for the entire family. These stores target moderate-income households. The dd's DISCOUNTS stores offer products at a 20% to 70% lesser price than the moderate department and discount stores.

Number of Employees: 107,000 |

|

|

| |

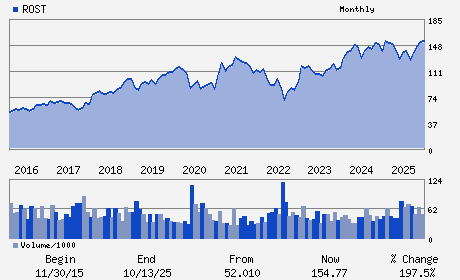

| • Price / Volume Information |

| Yesterday's Closing Price: $205.64 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,278,181 shares |

| Shares Outstanding: 323.45 (millions) |

| Market Capitalization: $66,513.21 (millions) |

| Beta: 0.97 |

| 52 Week High: $206.40 |

| 52 Week Low: $122.36 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.01% |

9.96% |

| 12 Week |

15.61% |

15.47% |

| Year To Date |

14.16% |

13.60% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

James G. Conroy - Chief Executive Officer and Director

Michael Balmuth - Executive Chairman and Director

Michael J. Hartshorn - Group President and Chief Operating Officer; Direc

Adam Orvos - Executive Vice President and Chief Financial Offic

Jeffrey P. Burrill - Senior Vice President; Chief Accounting Officer an

|

|

Peer Information

Ross Stores, Inc. (TGT)

Ross Stores, Inc. (BURL)

Ross Stores, Inc. (ALCSQ)

Ross Stores, Inc. (CLDRQ)

Ross Stores, Inc. (BLEEQ)

Ross Stores, Inc. (FDO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-DISCOUNT

Sector: Retail/Wholesale

CUSIP: 778296103

SIC: 5651

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/03/26

|

|

Share - Related Items

Shares Outstanding: 323.45

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.97

Market Capitalization: $66,513.21 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.79% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.62 |

Indicated Annual Dividend: $1.62 |

| Current Fiscal Year EPS Consensus Estimate: $7.14 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 8.05% |

Last Dividend Paid: 12/09/2025 - $0.41 |

| Next EPS Report Date: 03/03/26 |

|

|

|

| |