| Zacks Company Profile for SentinelOne, Inc. (S : NYSE) |

|

|

| |

| • Company Description |

| SentinelOne Inc. provides an autonomous cybersecurity platform. It offer cybersecurity solutions encompass AI-powered prevention, detection, response and hunting across endpoints, containers, cloud workloads and IoT devices in a single autonomous XDR platform. SentinelOne Inc. is based in MOUNTAIN VIEW, Calif.

Number of Employees: 2,800 |

|

|

| |

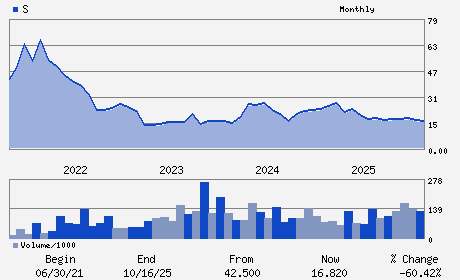

| • Price / Volume Information |

| Yesterday's Closing Price: $13.12 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 8,201,168 shares |

| Shares Outstanding: 339.87 (millions) |

| Market Capitalization: $4,459.08 (millions) |

| Beta: 0.77 |

| 52 Week High: $21.40 |

| 52 Week Low: $12.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.15% |

-5.33% |

| 12 Week |

-9.64% |

-9.75% |

| Year To Date |

-12.53% |

-12.96% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Tomer Weingarten - Chairman; President; and Chief Executive Officer

Barbara Larson - Chief Financial Officer

Robin Tomasello - Chief Accounting Officer

Charlene T. Begley - Director

Aaron Hughes - Director

|

|

Peer Information

SentinelOne, Inc. (CHKP)

SentinelOne, Inc. (ABST)

SentinelOne, Inc. (ZIXI)

SentinelOne, Inc. (FTNT)

SentinelOne, Inc. (GUID)

SentinelOne, Inc. (VRNS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Security

Sector: Computer and Technology

CUSIP: 81730H109

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 339.87

Most Recent Split Date: (:1)

Beta: 0.77

Market Capitalization: $4,459.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.16 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.55 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |