| Zacks Company Profile for comScore, Inc. (SCOR : NSDQ) |

|

|

| |

| • Company Description |

| ComScore, Inc. is a global leader in measuring the digital world. This capability is based on a massive, global cross-section of more than two million consumers who have given comScore permission to confidentially capture their browsing and transaction behavior, including online and offline purchasing. comScore panelists also participate in survey research that captures and integrates their attitudes and intentions. Through its proprietary technology, comScore measures what matters across a broad spectrum of behavior and attitudes. comScore analysts apply this deep knowledge of customers and competitors to help clients design powerful marketing strategies and tactics that deliver superior ROI. comScore services are used by global leaders such as AOL, Microsoft, Yahoo!, Verizon, Best Buy, The Newspaper Association of America, Tribune Interactive, ESPN, Fox Sports, Nestle, MBNA, Starcom USA, Universal McCann, the United States Postal Service, Merck and Expedia.

Number of Employees: 1,200 |

|

|

| |

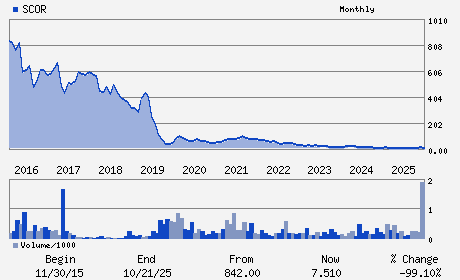

| • Price / Volume Information |

| Yesterday's Closing Price: $6.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 19,874 shares |

| Shares Outstanding: 5.02 (millions) |

| Market Capitalization: $34.16 (millions) |

| Beta: 1.14 |

| 52 Week High: $10.18 |

| 52 Week Low: $4.39 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-19.41% |

-18.70% |

| 12 Week |

1.49% |

1.37% |

| Year To Date |

4.77% |

4.26% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jonathan Carpenter - Chief Executive Officer and Director

Mary Margaret Curry - Chief Financial Officer and Treasurer

Nana Banerjee - Director

Itzhak Fisher - Director

Leslie Gillin - Director

|

|

Peer Information

comScore, Inc. (AGIS)

comScore, Inc. (SKCO)

comScore, Inc. (AWWC)

comScore, Inc. (AQUX)

comScore, Inc. (AVSV)

comScore, Inc. (AMGC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BUSINESS SVCS

Sector: Business Services

CUSIP: 20564W204

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/03/26

|

|

Share - Related Items

Shares Outstanding: 5.02

Most Recent Split Date: 12.00 (0.05:1)

Beta: 1.14

Market Capitalization: $34.16 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/03/26 |

|

|

|

| |