| Zacks Company Profile for Sound Financial Bancorp, Inc. (SFBC : NSDQ) |

|

|

| |

| • Company Description |

| Sound Financial Inc. is the holding company for Sound Community Bank, a full-service bank, providing personal and business banking services in communities across the greater Puget Sound region. The company is a mutual savings bank that provides financial services to families and individuals. Its products and services include real estate-lending, loans, checking accounts, savings and money market accounts, individual retirement accounts, certificate of deposits, online services, online loan applications, computerized lending, Internet access, and lines of credit. The company also provides money transfer services, money orders, overdraft protection, auto transfer/direct deposits, accidental death and dismemberment insurance, credit life and disability insurance, identity theft insurance, merchant services, and mortgage loans. The Seattle based company operates banking offices in King, Pierce, Snohomish and Clallam Counties.

Number of Employees: 123 |

|

|

| |

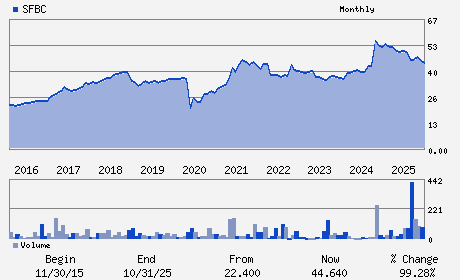

| • Price / Volume Information |

| Yesterday's Closing Price: $42.47 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,212 shares |

| Shares Outstanding: 2.57 (millions) |

| Market Capitalization: $108.98 (millions) |

| Beta: 0.11 |

| 52 Week High: $51.99 |

| 52 Week Low: $42.40 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.26% |

-2.41% |

| 12 Week |

-3.72% |

-3.84% |

| Year To Date |

-2.66% |

-3.13% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2400 3rd Avenue Suite 150

-

Seattle,WA 98121

USA |

ph: 206-448-0884

fax: - |

None |

http://www.soundcb.com |

|

|

| |

| • General Corporate Information |

Officers

Laura Lee Stewart - President; Chief Executive Officer

Tyler K. Myers - Chairman

Wesley Ochs - Executive Vice President and Chief Financial Offic

Jennifer L. Mallon - Senior Vice President

Robert F. Carney - Director

|

|

Peer Information

Sound Financial Bancorp, Inc. (CACB)

Sound Financial Bancorp, Inc. (CPF)

Sound Financial Bancorp, Inc. (FMBL)

Sound Financial Bancorp, Inc. (GRGN.)

Sound Financial Bancorp, Inc. (EVRT)

Sound Financial Bancorp, Inc. (EWBC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-WEST

Sector: Finance

CUSIP: 83607A100

SIC: 6035

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 2.57

Most Recent Split Date: (:1)

Beta: 0.11

Market Capitalization: $108.98 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.98% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.84 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: 0.27 |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/09/2026 - $0.21 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |