| Zacks Company Profile for SPAR Group, Inc. (SGRP : NSDQ) |

|

|

| |

| • Company Description |

| The SPAR Group, Inc. is a supplier of in-store merchandising and marketing services, and premium incentive marketing services throughout the United States and Canada. The company also provides database marketing, teleservices, marketing research, and Internet-based software. The company's operations are divided into three divisions: the Merchandising Services Division, the Incentive Marketing Division, and the Internet Division.

Number of Employees: 3,425 |

|

|

| |

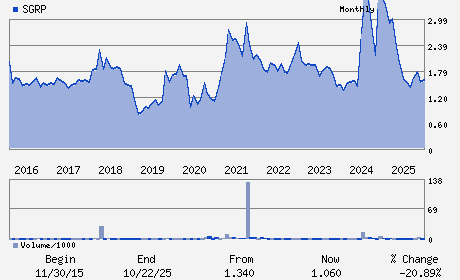

| • Price / Volume Information |

| Yesterday's Closing Price: $0.78 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 22,509 shares |

| Shares Outstanding: 23.95 (millions) |

| Market Capitalization: $18.72 (millions) |

| Beta: 0.07 |

| 52 Week High: $1.60 |

| 52 Week Low: $0.73 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.56% |

-0.70% |

| 12 Week |

-10.99% |

-11.10% |

| Year To Date |

-1.18% |

-1.66% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael R. Matacunas - Chief Executive Officer; President and Director

Antonio Calisto Pato - Chief Financial Officer; Treasurer and Secretary

James R. Gillis - Director

John Bode - Director

Linda Houston - Director

|

|

Peer Information

SPAR Group, Inc. (AGIS)

SPAR Group, Inc. (SKCO)

SPAR Group, Inc. (AWWC)

SPAR Group, Inc. (AQUX)

SPAR Group, Inc. (AVSV)

SPAR Group, Inc. (AMGC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BUSINESS SVCS

Sector: Business Services

CUSIP: 784933103

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/06/26

|

|

Share - Related Items

Shares Outstanding: 23.95

Most Recent Split Date: (:1)

Beta: 0.07

Market Capitalization: $18.72 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/06/26 |

|

|

|

| |