| Zacks Company Profile for Shin-Etsu Chemical Co. (SHECY : OTC) |

|

|

| |

| • Company Description |

| Shin-Etsu Chemical Co., Ltd. is engaged in the production and distribution of polyvinyl chloride and silicon wafers. The Company's products include of polyvinyl chloride, silicones, rare earths, rare earth magnets, epoxy molding compounds, synthetic Quartz, semiconductor silicon and cellulose derivatives. Shin-Etsu Chemical Co., Ltd. is headquartered in Tokyo, Japan.

Number of Employees: 27,274 |

|

|

| |

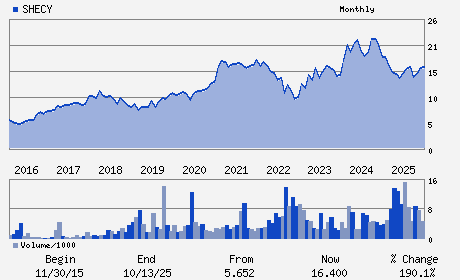

| • Price / Volume Information |

| Yesterday's Closing Price: $19.64 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 569,403 shares |

| Shares Outstanding: 3,969.99 (millions) |

| Market Capitalization: $77,970.63 (millions) |

| Beta: 1.33 |

| 52 Week High: $20.93 |

| 52 Week Low: $11.95 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

19.39% |

20.44% |

| 12 Week |

26.22% |

26.07% |

| Year To Date |

26.71% |

26.09% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

4-1 Marunouchi 1-chome Chiyoda-ku

-

Tokyo,M0 100-0005

JPN |

ph: 813-6812-2340

fax: 813-3246-5096 |

sec-pr@shinetsu.jp |

http://www.shinetsu.co.jp |

|

|

| |

| • General Corporate Information |

Officers

Fumio Akiya - Chairman

Yasuhiko Saitoh - President

Susumu Ueno - Director

Masahiko Todoroki - Director

Shunzo Mor - Director

|

|

Peer Information

Shin-Etsu Chemical Co. (ENFY)

Shin-Etsu Chemical Co. (EMLIF)

Shin-Etsu Chemical Co. (GPLB)

Shin-Etsu Chemical Co. (BCPUQ)

Shin-Etsu Chemical Co. (CYT.)

Shin-Etsu Chemical Co. (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 824551105

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 3,969.99

Most Recent Split Date: 4.00 (2.50:1)

Beta: 1.33

Market Capitalization: $77,970.63 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.17% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.23 |

| Current Fiscal Year EPS Consensus Estimate: $0.81 |

Payout Ratio: 0.27 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |