| Zacks Company Profile for National Steel Company (SID : NYSE) |

|

|

| |

| • Company Description |

| Companhia Sider?rgica Nacional or National Steel Company is one of the largest fully integrated steel producers in Brazil and Latin America in terms of crude steel production. The Steel segment comprises a portfolio of diverse products and provides an international footprint by means of international subsidiaries and exports from Brazil. In flat steel segment, NSC is a fully-integrated steelmaker. Steelworks produces a broad line of steel products, including slabs, hot and cold rolled, galvanized and tin mill products for the distribution, packaging, automotive, home appliance and construction industries. In Mining unit, NSC owns a number of high quality iron ore mines, strategically located within Brazil's 'Iron Ore Quadrangle'. In Logistics unit, NSC's vertical integration strategy and the synergies among business units are strongly dependent on the logistics needed to guarantee the transportation of inputs at low cost.

Number of Employees: 29,695 |

|

|

| |

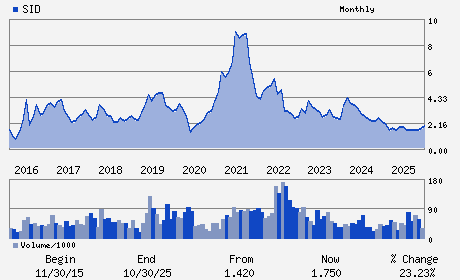

| • Price / Volume Information |

| Yesterday's Closing Price: $1.68 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 4,451,865 shares |

| Shares Outstanding: 1,326.09 (millions) |

| Market Capitalization: $2,227.84 (millions) |

| Beta: 1.67 |

| 52 Week High: $2.20 |

| 52 Week Low: $1.24 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-12.04% |

-11.27% |

| 12 Week |

2.44% |

2.31% |

| Year To Date |

5.00% |

4.49% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

AV. BRIGADEIRO FARIA LIMA 3400 - 20TH FLOOR

-

S?a?'O PAULO,D5 04538-132

BRA |

ph: 55-11-3049-7585

fax: 55-11-3049-7212 |

invrel@csn.com |

https://ri.csn.com.br/en |

|

|

| |

| • General Corporate Information |

Officers

Benjamin Steinbruch - Chief Executive Officer;Chairman

AntonioMarcoCampos Rabello - Chief Financial and Investor Relations Officer

MarceloCunha Ribeiro - Director

David Moise Salama - Executive Officer

Stephan Heinz Josef Weber - Executive Officer

|

|

Peer Information

National Steel Company (M.DFS)

National Steel Company (ARBD.)

National Steel Company (FSTR)

National Steel Company (HLESF)

National Steel Company (HLETY)

National Steel Company (T.RUS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: STEEL-PRODUCERS

Sector: Basic Materials

CUSIP: 20440W105

SIC: 3310

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/11/26

|

|

Share - Related Items

Shares Outstanding: 1,326.09

Most Recent Split Date: 4.00 (2.00:1)

Beta: 1.67

Market Capitalization: $2,227.84 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.22 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/11/26 |

|

|

|

| |