| Zacks Company Profile for Sun Life Financial Inc. (SLF : NYSE) |

|

|

| |

| • Company Description |

| Sun Life, being the third largest insurer in Canada & well diversified by geography and product, provides protection and wealth management products and services to individual and group customers worldwide. It reports its financial results through five business segments: SLF Canada, SLF U.S., MFS Investment Management, SLF Asia and Corporate. SLF Canada consists of Individual Insurance and Investments, Group Benefits and Group Retirement Services' and offers a full range of protection and wealth accumulation products and services to individuals and corporate clients. SLF U.S. consists of Employee Benefits Group, Annuities and Individual Insurance. The company, however, continues to provide high-quality service for these existing policyholders. MFS, a global asset management firm, offers a comprehensive range of financial products and services. The unit actively manages assets for retail and institutional investors around the world through mutual funds, separately managed accounts and retirement plans.

Number of Employees: 32,151 |

|

|

| |

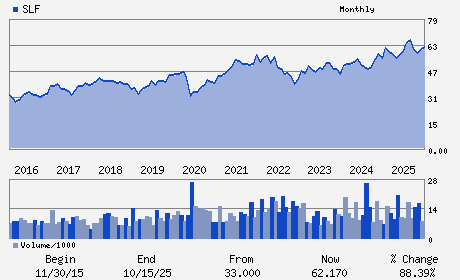

| • Price / Volume Information |

| Yesterday's Closing Price: $65.55 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 957,849 shares |

| Shares Outstanding: 553.87 (millions) |

| Market Capitalization: $36,306.40 (millions) |

| Beta: 0.87 |

| 52 Week High: $69.67 |

| 52 Week Low: $52.44 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.98% |

4.89% |

| 12 Week |

11.90% |

11.76% |

| Year To Date |

5.05% |

4.54% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kevin D. Strain - Chief Executive Officer and President

Scott F. Powers - Chairman

Timothy Deacon - Executive Vice-President and Chief Financial Offic

Deepak Chopra - Director

Stephanie L. Coyles - Director

|

|

Peer Information

Sun Life Financial Inc. (AGC.)

Sun Life Financial Inc. (T.GWO)

Sun Life Financial Inc. (AMH.2)

Sun Life Financial Inc. (CSLI.)

Sun Life Financial Inc. (CIA)

Sun Life Financial Inc. (DFG)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INS-LIFE

Sector: Finance

CUSIP: 866796105

SIC: 6311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 553.87

Most Recent Split Date: (:1)

Beta: 0.87

Market Capitalization: $36,306.40 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.09% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.37 |

Indicated Annual Dividend: $2.68 |

| Current Fiscal Year EPS Consensus Estimate: $5.73 |

Payout Ratio: 0.49 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/25/2026 - $0.67 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |