| Zacks Company Profile for Simulations Plus, Inc. (SLP : NSDQ) |

|

|

| |

| • Company Description |

| Simulations Plus, Inc., is a premier developer of groundbreaking drug discovery and development simulation software, which is licensed to and used in the conduct of drug research by major pharmaceutical and biotechnology companies worldwide. They have two other businesses, Words+, Inc. and FutureLab, which are based on its proprietary software technologies.

Number of Employees: 213 |

|

|

| |

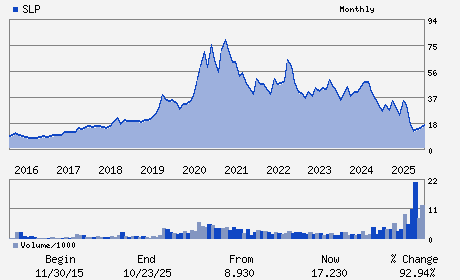

| • Price / Volume Information |

| Yesterday's Closing Price: $12.23 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 406,863 shares |

| Shares Outstanding: 20.15 (millions) |

| Market Capitalization: $246.39 (millions) |

| Beta: 1.18 |

| 52 Week High: $36.45 |

| 52 Week Low: $11.16 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-27.59% |

-26.96% |

| 12 Week |

-37.73% |

-37.81% |

| Year To Date |

-32.91% |

-33.24% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Shawn O'Connor - Chief Executive Officer

Dr. Daniel Weiner - Chairman of the Board of Directors

Will Frederick - Chief Financial Officer and Executive Vice Presid

Walter S. Woltosz - Director

Dr. Lisa LaVange - Director

|

|

Peer Information

Simulations Plus, Inc. (ATEA)

Simulations Plus, Inc. (BITS.)

Simulations Plus, Inc. (DCTM)

Simulations Plus, Inc. (DLVAZ)

Simulations Plus, Inc. (DOCC)

Simulations Plus, Inc. (NEON)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-SOFTWARE

Sector: Computer and Technology

CUSIP: 829214105

SIC: 7373

|

|

Fiscal Year

Fiscal Year End: August

Last Reported Quarter: 11/01/25

Next Expected EPS Date: 04/02/26

|

|

Share - Related Items

Shares Outstanding: 20.15

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.18

Market Capitalization: $246.39 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.27 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.03 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.29 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/02/26 |

|

|

|

| |