| Zacks Company Profile for Super Micro Computer, Inc. (SMCI : NSDQ) |

|

|

| |

| • Company Description |

| Super Micro Computer, Inc. designs, develops, manufactures and sells energy-efficient, application optimized server solutions based on the x86 architecture. The Company's solutions include a range of rack mount and blade server systems, as well as components. Supermicro emphasizes superior product design and uncompromising quality control to produce industry-leading serverboards, chassis and server systems. These Server Building Block Solutions provide benefits across many environments, including data center deployment, high-performance computing, high-end workstations, storage networks and standalone server installations. Super Micro Computer sells its server systems and components primarily through distributors, which include value-added resellers and system integrators, and to a lesser extent, to original equipment manufacturers (OEMs). Super Micro Computer, Inc. is headquartered in San Jose, California.

Number of Employees: 6,238 |

|

|

| |

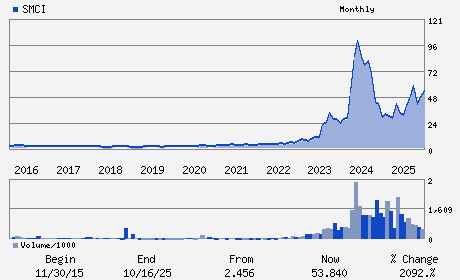

| • Price / Volume Information |

| Yesterday's Closing Price: $32.39 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 32,817,142 shares |

| Shares Outstanding: 598.99 (millions) |

| Market Capitalization: $19,401.27 (millions) |

| Beta: 1.52 |

| 52 Week High: $62.36 |

| 52 Week Low: $27.60 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.27% |

12.24% |

| 12 Week |

-6.63% |

-6.75% |

| Year To Date |

10.66% |

10.12% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Charles Liang - Chief Executive Officer; Chairman and President

David Weigand - Senior Vice President; Chief Financial Officer

Kenneth Cheung - Senior Vice President; Chief Accounting Officer

Sara Liu - Director

Judy Lin - Director

|

|

Peer Information

Super Micro Computer, Inc. (CPCIQ)

Super Micro Computer, Inc. (SNDK)

Super Micro Computer, Inc. (CBEX)

Super Micro Computer, Inc. (DTLK)

Super Micro Computer, Inc. (LCRD)

Super Micro Computer, Inc. (FLSH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-STORAGE DE

Sector: Computer and Technology

CUSIP: 86800U302

SIC: 3571

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 598.99

Most Recent Split Date: 10.00 (10.00:1)

Beta: 1.52

Market Capitalization: $19,401.27 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.54 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.80 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 28.11% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |