| Zacks Company Profile for The Scotts Miracle-Gro Company (SMG : NYSE) |

|

|

| |

| • Company Description |

| The Scotts Miracle-Gro Company is a leading producer and marketer of branded garden and consumer lawn products. The company makes, markets and sells garden and lawn products in various categories. Its products are marketed under some of the most recognized brands like Scotts & Turf Builder lawn and grass seed products, LiquaFeed and Osmocote gardening and landscape products, Miracle-Gro plant fertilizers, EverGreen lawn fertilizers, Weedol and Pathclear herbicides and Levington gardening and landscape products. Its has three reportable business segments: U.S. Consumer, Hawthorne and Other. U.S. Consumer division consists of consumer garden and lawn business. The lawn care products also include lawn-related pest, weed and disease control products. Hawthorne segment consists of urban, indoor and hydroponic gardening business. Other division consists of consumer lawn and garden business in regions other than the U.S. and the products are sold to commercial nurseries, greenhouses and other professional customers.

Number of Employees: 5,900 |

|

|

| |

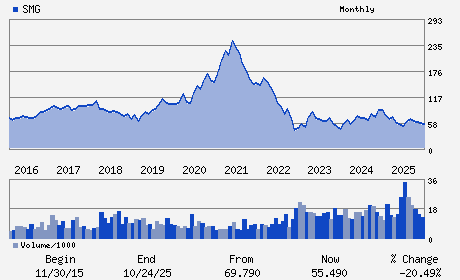

| • Price / Volume Information |

| Yesterday's Closing Price: $70.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 782,040 shares |

| Shares Outstanding: 58.04 (millions) |

| Market Capitalization: $4,084.84 (millions) |

| Beta: 1.96 |

| 52 Week High: $72.35 |

| 52 Week Low: $45.61 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.90% |

14.45% |

| 12 Week |

34.36% |

33.68% |

| Year To Date |

20.62% |

19.98% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

James Hagedorn - Chairman and Chief Executive Officer

Nathan E. Baxter - President and Chief Operating Officer

Mark J. Scheiwer - Executive Vice President; Chief Financial Officer

Dimiter Todorov - Executive Vice President; Chief Legal Officer and

Edith Aviles - Director

|

|

Peer Information

The Scotts Miracle-Gro Company (DLP)

The Scotts Miracle-Gro Company (CPKPY)

The Scotts Miracle-Gro Company (ABTXQ)

The Scotts Miracle-Gro Company (ADM)

The Scotts Miracle-Gro Company (CRESY)

The Scotts Miracle-Gro Company (PYYX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AGRI OPERATIONS

Sector: Consumer Staples

CUSIP: 810186106

SIC: 2870

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 58.04

Most Recent Split Date: 11.00 (2.00:1)

Beta: 1.96

Market Capitalization: $4,084.84 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.75% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.90 |

Indicated Annual Dividend: $2.64 |

| Current Fiscal Year EPS Consensus Estimate: $4.26 |

Payout Ratio: 0.69 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.43 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/20/2026 - $0.66 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |