| Zacks Company Profile for Semtech Corporation (SMTC : NSDQ) |

|

|

| |

| • Company Description |

| Semtech Corporation designs, manufactures and markets a wide range of analog and mixed- signal semiconductors for commercial applications. The product line comprises Signal Integrity Products, Protection Products, Power and High-Reliability Products, Wireless and Sensing Products, and Systems Innovation Group. The company's devices are used in a variety of applications including computer, communications, industrial, military-aerospace and automotive. The company also provides a limited amount of wafer foundry services to other electronic component manufacturers. Semtech has manufacturing facilities in Irvine, Camarillo and San Diego in California, Reynosa in Mexico and Neuch?tel in Switzerland.

Number of Employees: 1,838 |

|

|

| |

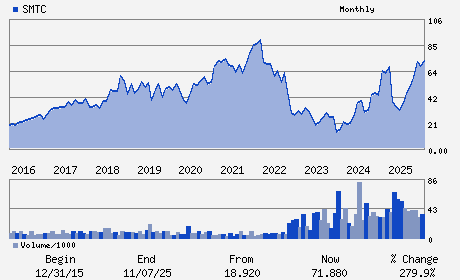

| • Price / Volume Information |

| Yesterday's Closing Price: $90.22 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,465,664 shares |

| Shares Outstanding: 92.54 (millions) |

| Market Capitalization: $8,348.96 (millions) |

| Beta: 1.99 |

| 52 Week High: $96.46 |

| 52 Week Low: $24.05 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

13.13% |

14.12% |

| 12 Week |

13.33% |

13.19% |

| Year To Date |

22.43% |

21.84% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Hong Q. Hou - Chief Executive Officer and President

Ye Jane Li - Chair of the Board

Mark Lin - Executive Vice President and Chief Financial Offic

Rodolpho Cardenuto - Director

Gregory M. Fischer - Director

|

|

Peer Information

Semtech Corporation (ADI)

Semtech Corporation (MXL)

Semtech Corporation (SMTC)

Semtech Corporation (SLAB)

Semtech Corporation (MCHP)

Semtech Corporation (MCRL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEMI-ANALOG & MIXED

Sector: Computer and Technology

CUSIP: 816850101

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/12/26

|

|

Share - Related Items

Shares Outstanding: 92.54

Most Recent Split Date: 9.00 (2.00:1)

Beta: 1.99

Market Capitalization: $8,348.96 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.28 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.56 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/12/26 |

|

|

|

| |